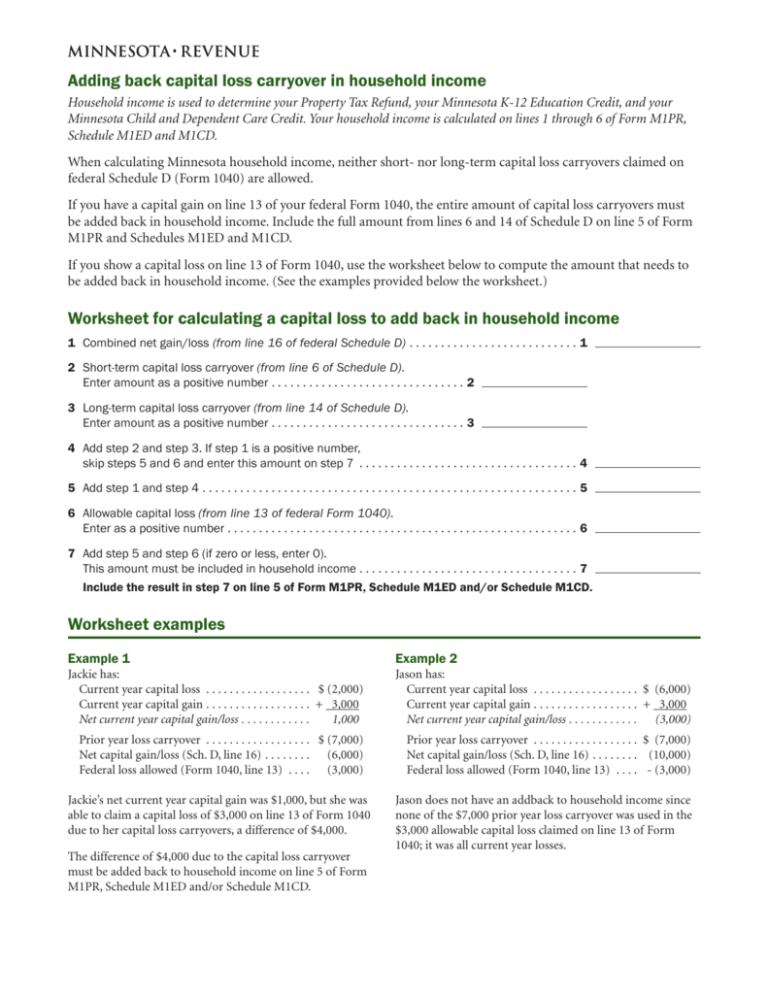

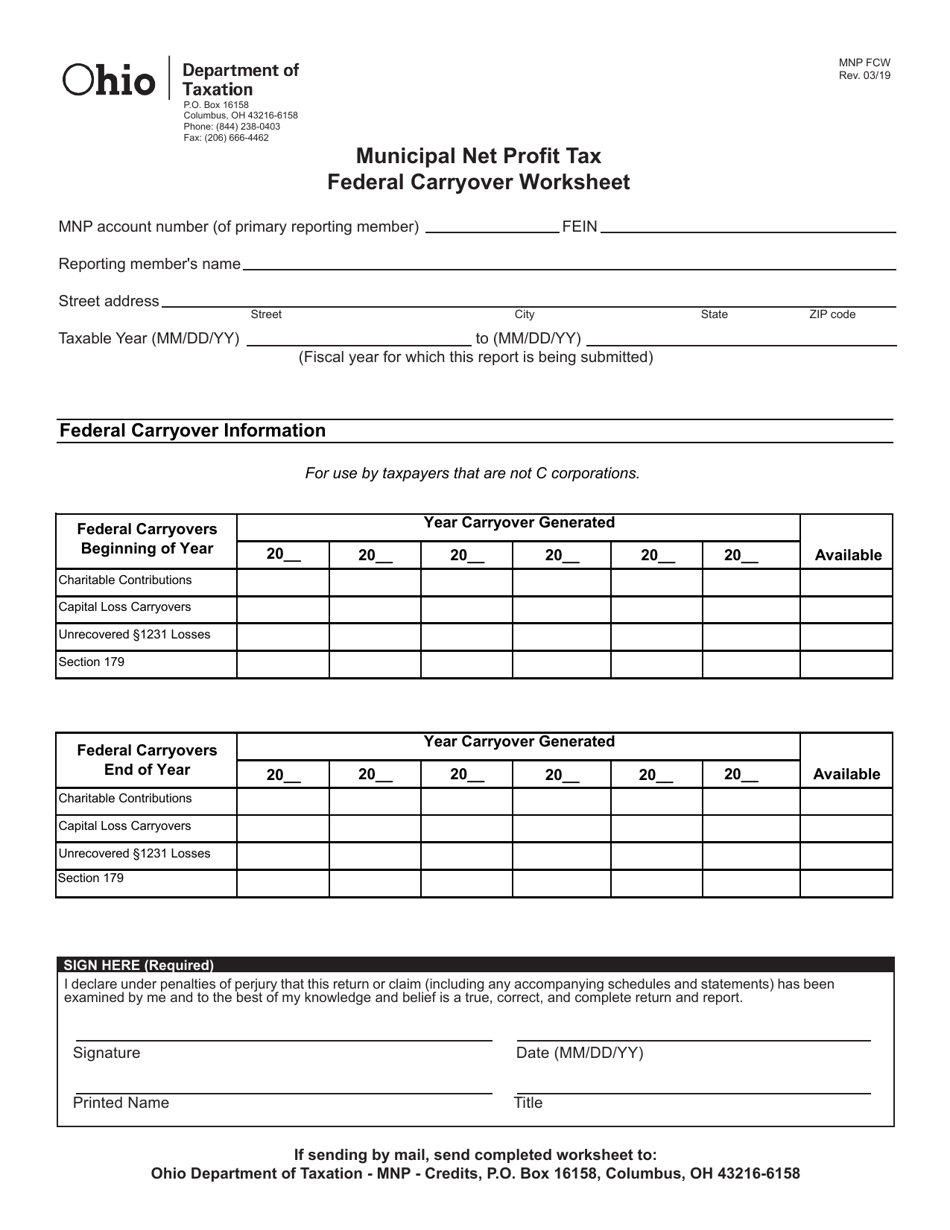

What Is A Federal Carryover Worksheet - You would not carry over your 2019 income to this worksheet. Turbotax fills it out for. This worksheet helps determine how much of the unused loss from the previous year can be applied. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Learn how to generate a federal carryover worksheet, including key qualifications,. These instructions explain how to complete schedule d (form 1040). What is the federal carryover worksheet in turbotax?

What is the federal carryover worksheet in turbotax? This worksheet helps determine how much of the unused loss from the previous year can be applied. Learn how to generate a federal carryover worksheet, including key qualifications,. You would not carry over your 2019 income to this worksheet. Turbotax fills it out for. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040).

These instructions explain how to complete schedule d (form 1040). What is the federal carryover worksheet in turbotax? You would not carry over your 2019 income to this worksheet. Turbotax fills it out for. Learn how to generate a federal carryover worksheet, including key qualifications,. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. This worksheet helps determine how much of the unused loss from the previous year can be applied.

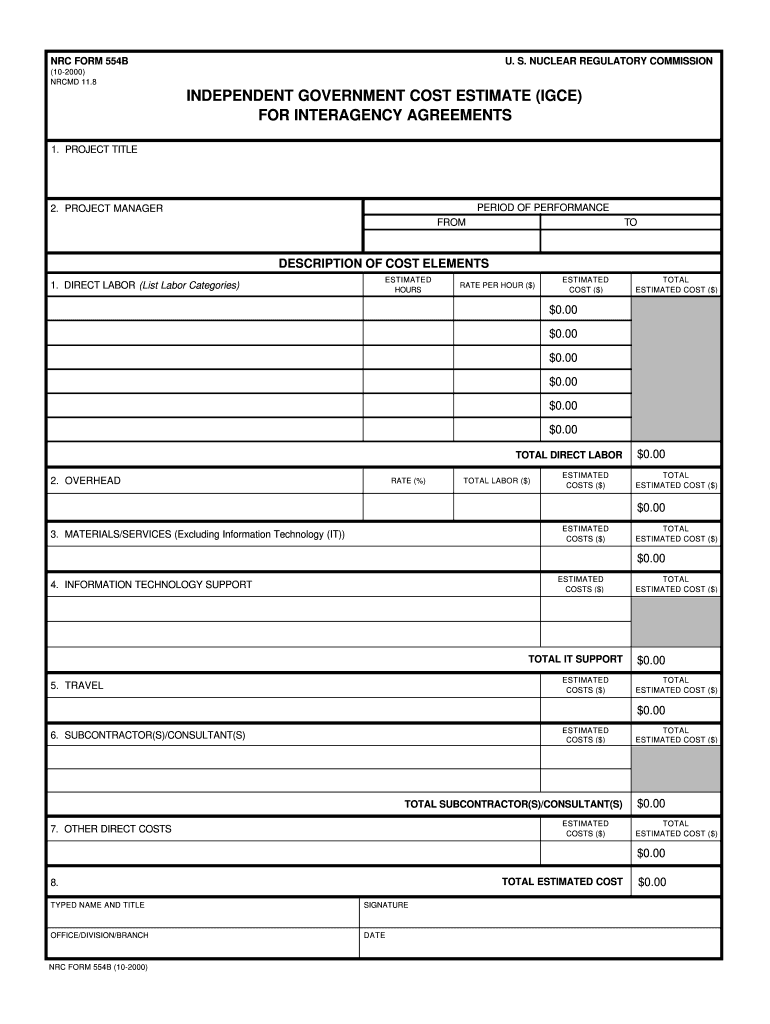

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Turbotax fills it out for. Learn how to generate a federal carryover worksheet, including key qualifications,. These instructions explain how to complete schedule d (form 1040). This worksheet helps determine how much of the unused loss from the previous year can be applied.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

This worksheet helps determine how much of the unused loss from the previous year can be applied. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Turbotax fills it out for. You would not carry over your 2019 income to this worksheet. What is the federal carryover worksheet in turbotax?

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

Turbotax fills it out for. This worksheet helps determine how much of the unused loss from the previous year can be applied. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Learn how to generate a federal carryover worksheet, including key qualifications,. You would not carry over your 2019 income to this worksheet.

1040 (2023) Internal Revenue Service Worksheets Library

Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Learn how to generate a federal carryover worksheet, including key qualifications,. These instructions explain how to complete schedule d (form 1040). This worksheet helps determine how much of the unused loss from the previous year can be applied. Turbotax fills it out for.

Carryover Worksheet Total Withheld Pmts Printable And Enjoyable Learning

Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Learn how to generate a federal carryover worksheet, including key qualifications,. This worksheet helps determine how much of the unused loss from the previous year can be applied. You would not carry over your 2019 income to this worksheet. Turbotax fills it out for.

What Is A Federal Carryover Worksheet Printable Word Searches

This worksheet helps determine how much of the unused loss from the previous year can be applied. What is the federal carryover worksheet in turbotax? Turbotax fills it out for. You would not carry over your 2019 income to this worksheet. These instructions explain how to complete schedule d (form 1040).

What Is A Federal Carryover Worksheet Printable Word Searches

Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040). This worksheet helps determine how much of the unused loss from the previous year can be applied. Turbotax fills it out for. You would not carry over your 2019 income to this worksheet.

Federal Carryover Worksheet Total Withheld Pmts Publication

You would not carry over your 2019 income to this worksheet. Turbotax fills it out for. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040). Learn how to generate a federal carryover worksheet, including key qualifications,.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

This worksheet helps determine how much of the unused loss from the previous year can be applied. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. What is the federal carryover worksheet in turbotax? These instructions explain how to complete schedule d (form 1040). Turbotax fills it out for.

What Is A Federal Carryover Worksheet Printable Word Searches

Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040). Learn how to generate a federal carryover worksheet, including key qualifications,. What is the federal carryover worksheet in turbotax? This worksheet helps determine how much of the unused loss from the previous year can.

What Is The Federal Carryover Worksheet In Turbotax?

You would not carry over your 2019 income to this worksheet. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040). Learn how to generate a federal carryover worksheet, including key qualifications,.

This Worksheet Helps Determine How Much Of The Unused Loss From The Previous Year Can Be Applied.

Turbotax fills it out for.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)