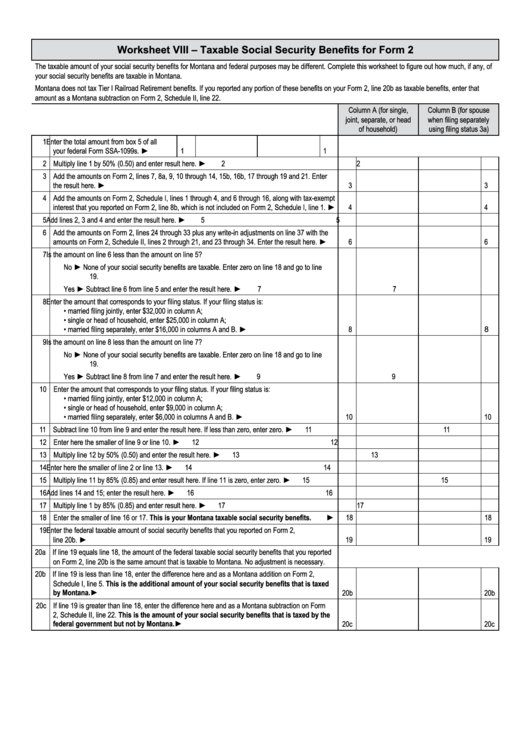

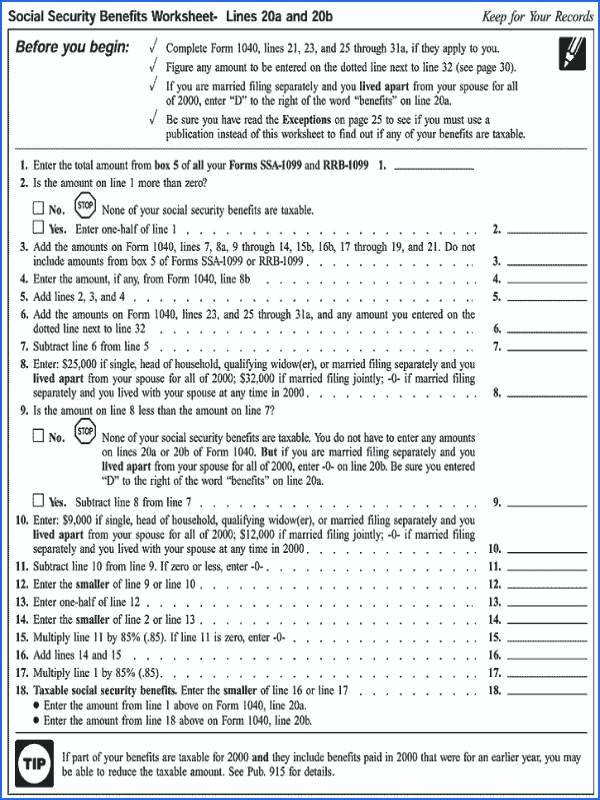

Social Security Benefit Worksheet - The worksheet provided can be used to determine the exact amount. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The taxable portion can range from 50 to 85 percent of your benefits.

The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable.

The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable.

Taxable Social Security Benefits Worksheet

This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits.

Taxation of Social Security Benefits KLRD Worksheets Library

This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount.

Social Security Benefits Taxable Amount Worksheet Worksheet

The worksheet provided can be used to determine the exact amount. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The taxable portion can range from 50 to 85 percent of your benefits.

Worksheet 1. Figuring Your Taxable Benefits Keep For Your Records

The taxable portion can range from 50 to 85 percent of your benefits. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The worksheet provided can be used to determine the exact amount.

Social Security Taxable Benefits Worksheet 2023 Taxable Soci

The taxable portion can range from 50 to 85 percent of your benefits. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The worksheet provided can be used to determine the exact amount.

Taxable Social Security Benefits Worksheet

The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable.

Social Security Benefits Worksheet 2021 Pdf

This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits.

Worksheet Taxable Social Security Benefits Printable Calendars AT A

This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits.

Social Security Benefits Worksheet 2022

The worksheet provided can be used to determine the exact amount. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The taxable portion can range from 50 to 85 percent of your benefits.

Taxable Social Security Benefits Worksheet

The worksheet provided can be used to determine the exact amount. This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The taxable portion can range from 50 to 85 percent of your benefits.

The Taxable Portion Can Range From 50 To 85 Percent Of Your Benefits.

This lesson will help you determine whether income from taxpayers' social security benefits and railroad retirement benefits is taxable. The worksheet provided can be used to determine the exact amount.