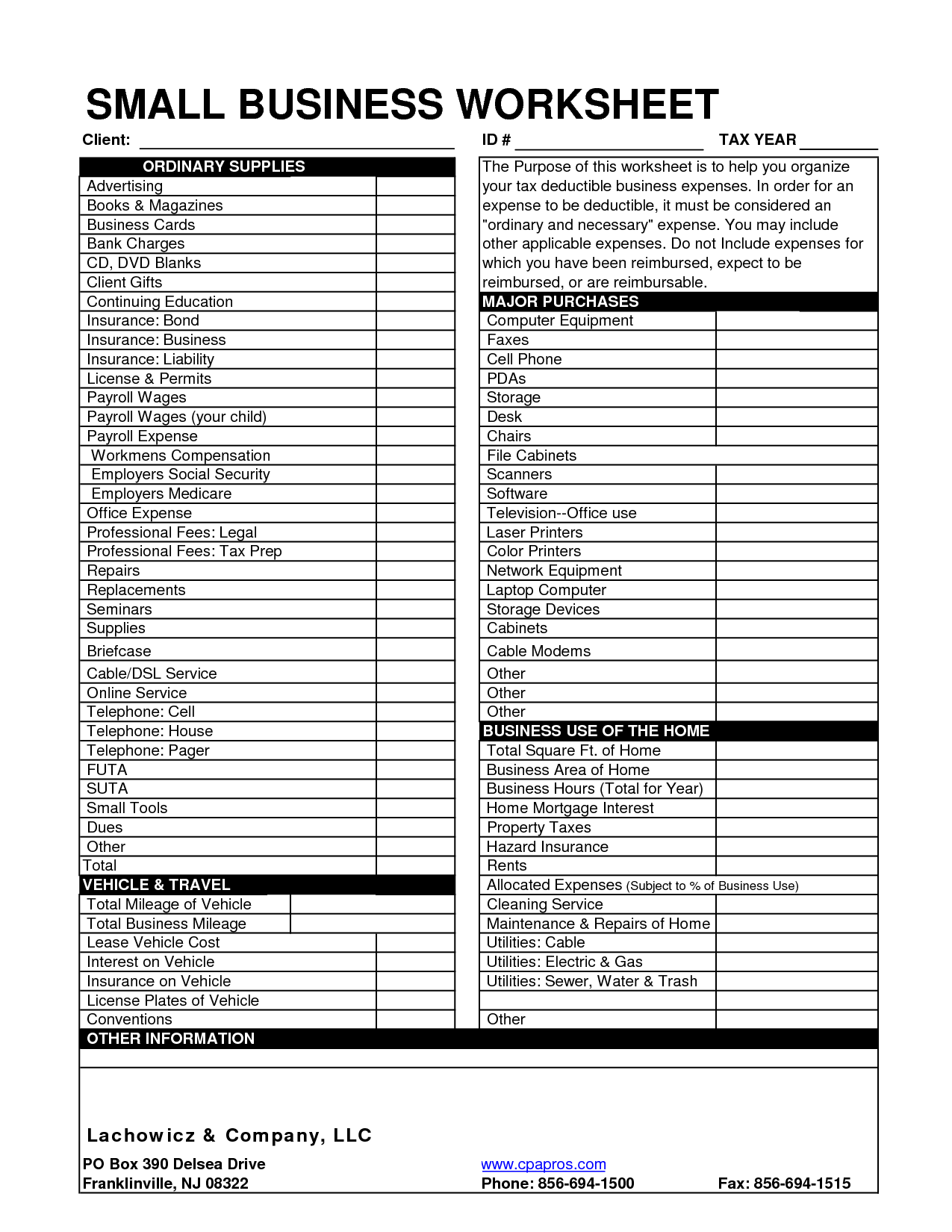

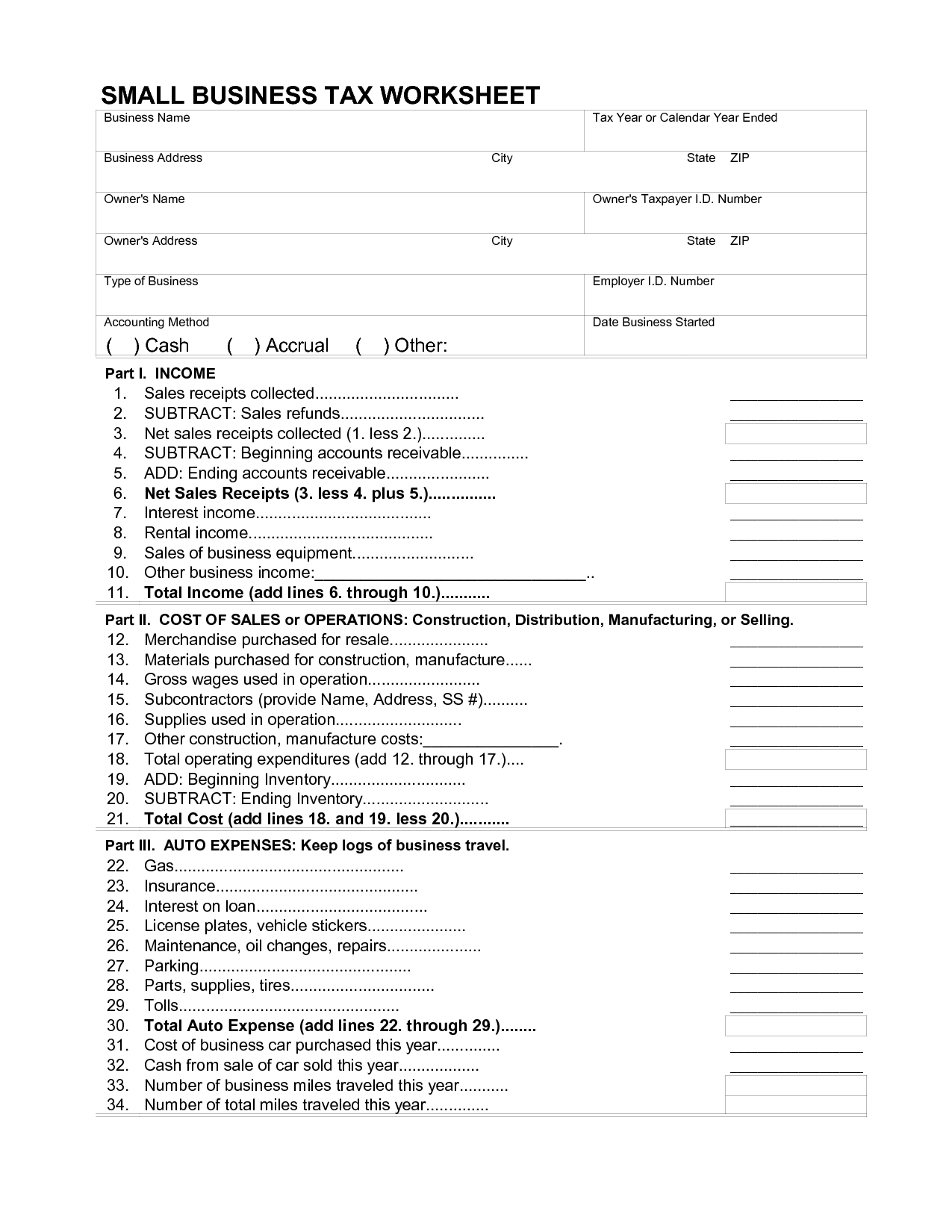

Small Business Tax Worksheet - Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. In order for an expense to be deductible, it must. The purpose of this worksheet is to help you organize your tax deductible business expenses. Visit business structures for structure specific forms and publications recommendations.

Visit business structures for structure specific forms and publications recommendations. In order for an expense to be deductible, it must. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. The purpose of this worksheet is to help you organize your tax deductible business expenses.

Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. In order for an expense to be deductible, it must. The purpose of this worksheet is to help you organize your tax deductible business expenses. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. Visit business structures for structure specific forms and publications recommendations.

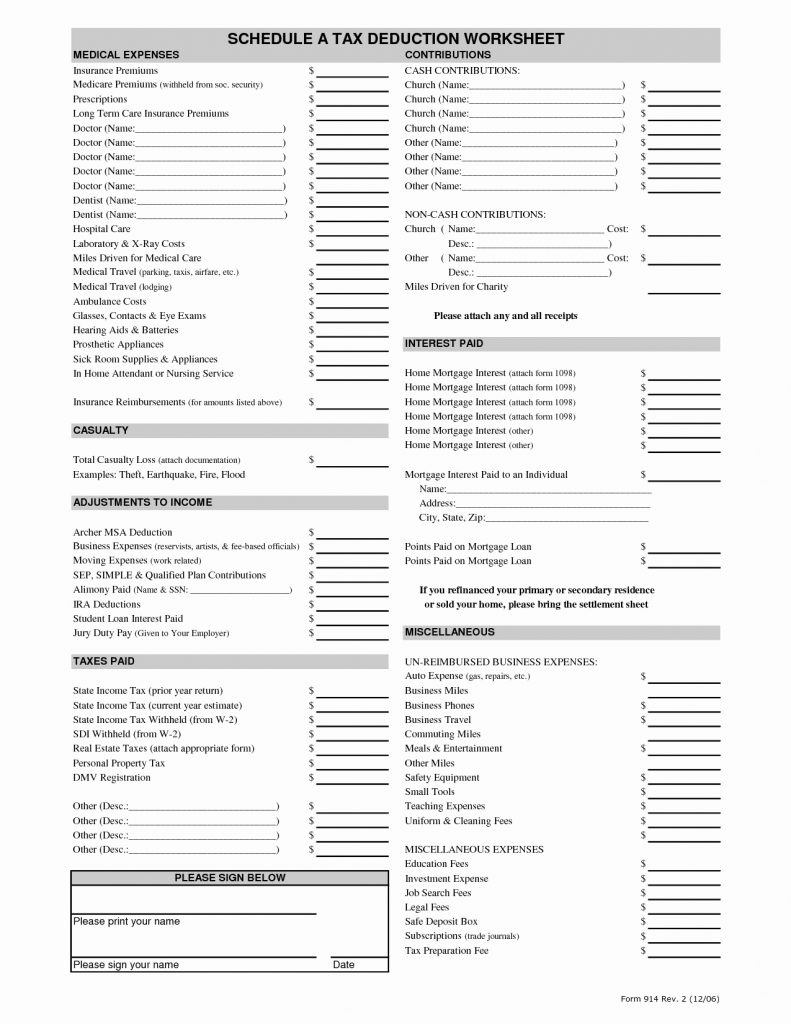

Tax Preparation Guide Sheet

Visit business structures for structure specific forms and publications recommendations. In order for an expense to be deductible, it must. The purpose of this worksheet is to help you organize your tax deductible business expenses. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. Use this comprehensive checklist to.

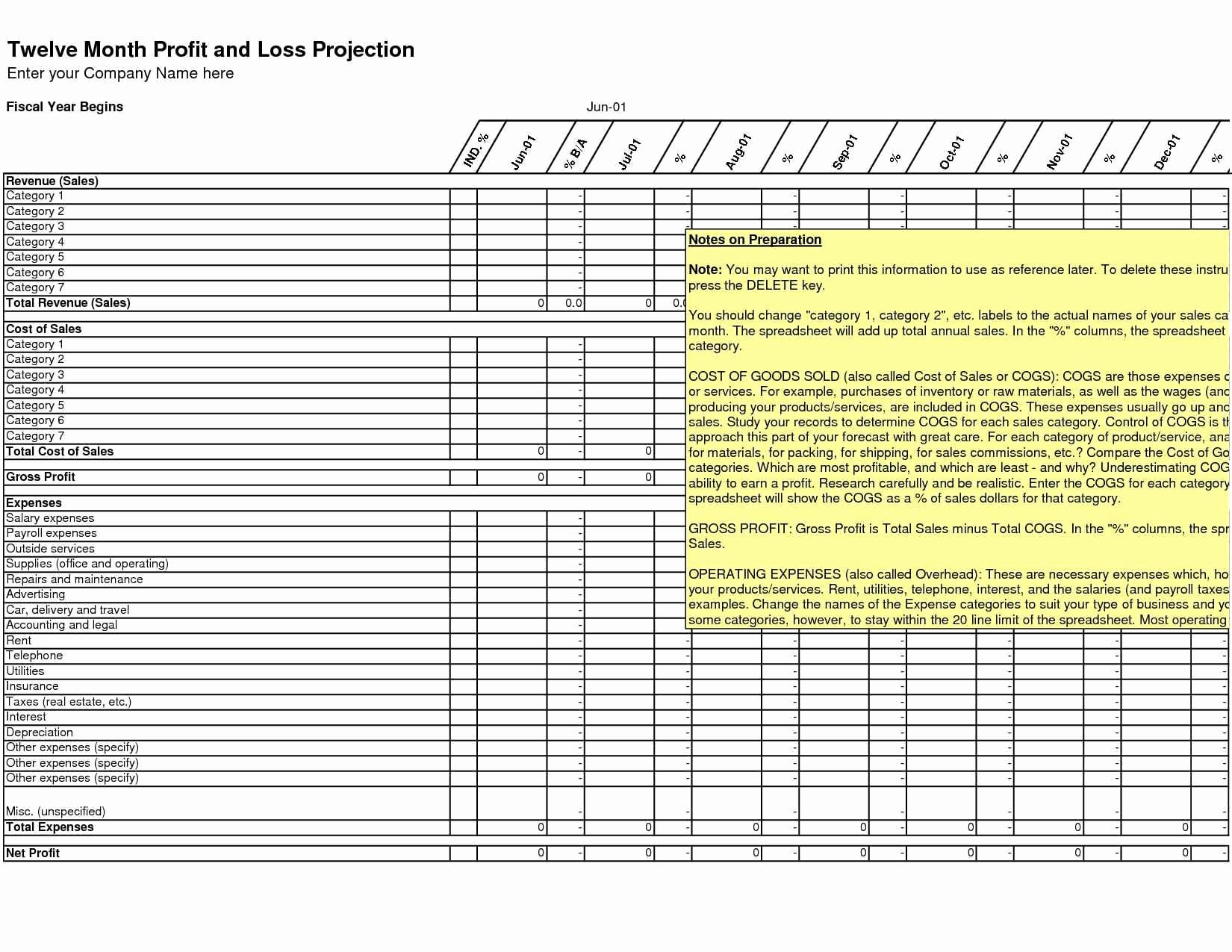

Small Business Tax Spreadsheet Excel Deductions Worksheet —

Visit business structures for structure specific forms and publications recommendations. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. The purpose of this worksheet is to help you organize your tax deductible business expenses. Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently.

Small Business Tax Spreadsheet Template —

Visit business structures for structure specific forms and publications recommendations. Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. In order for an expense to be deductible, it must. The.

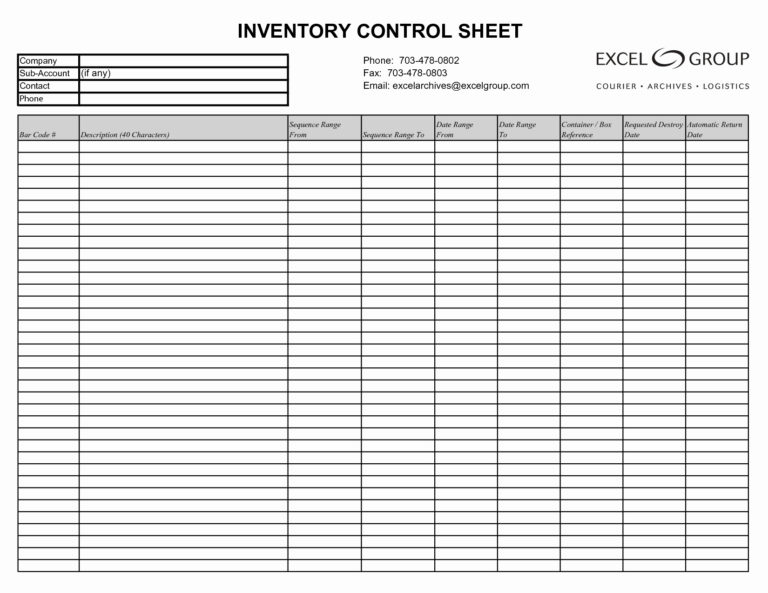

Tax Spreadsheet For Small Business for Small Business Tax Spreadsheet

Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. The purpose of this worksheet is to help you organize your tax deductible business expenses. Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. Visit business structures for structure specific.

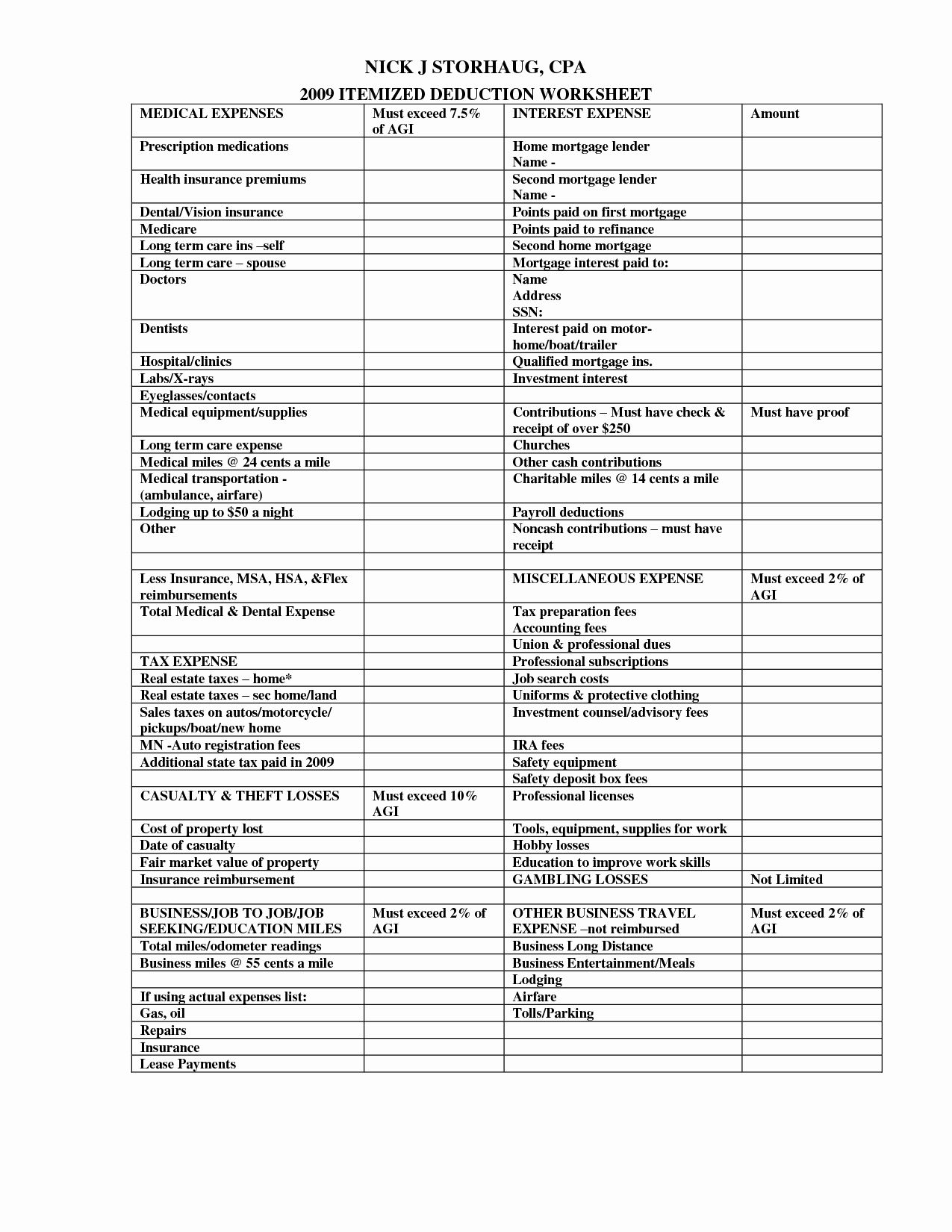

Itemized Deduction Small Business Tax Deductions Worksheet

Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must. Visit business structures for structure specific forms and publications recommendations. Previous year’s tax return—up to 3.

Printable Small Business Tax Deductions Worksheet

Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. Visit business structures for structure specific forms and publications recommendations. In order for an expense to be deductible, it must. The.

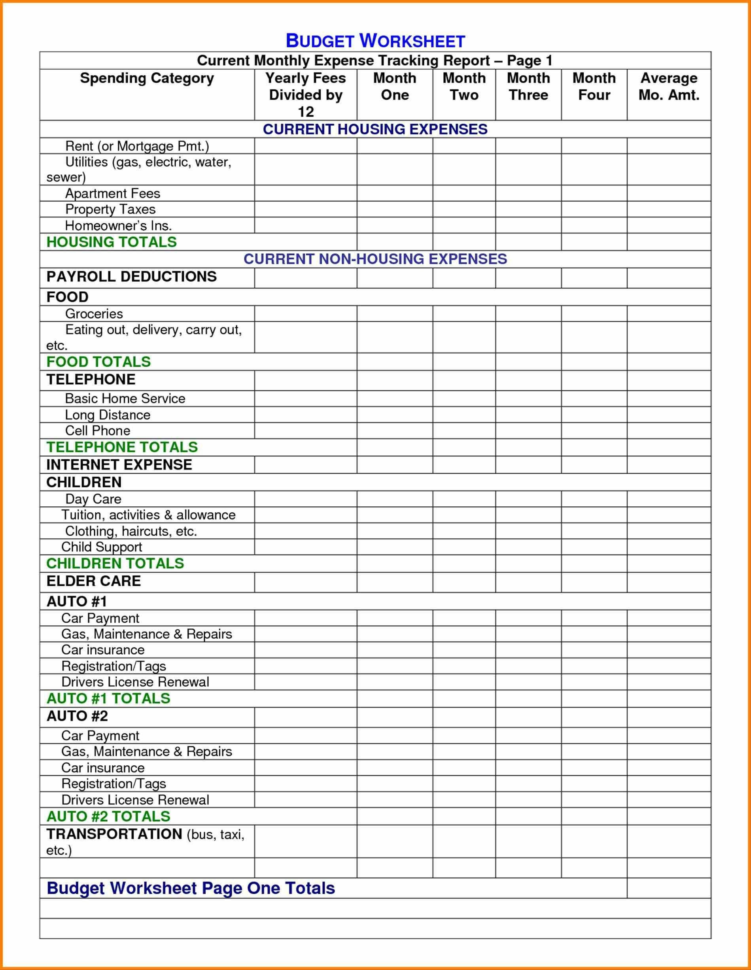

Self Employed Tax Deductions Worksheet Small Business Tax De

Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and.

Small Business Tax Deductions Worksheet 2022

In order for an expense to be deductible, it must. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. The purpose of this worksheet is to help you organize your tax deductible business expenses. Visit business structures for structure specific forms and publications recommendations. Use this comprehensive checklist to.

Printable Self Employed Tax Deductions Worksheet Small Busin

Visit business structures for structure specific forms and publications recommendations. Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently complete your tax return. In order for an expense to be deductible, it must. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. The.

Home Business Tax Deductions Worksheet 8 Best Images Of Tax

The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. Use this comprehensive checklist to ensure you have everything you need to accurately and efficiently.

Use This Comprehensive Checklist To Ensure You Have Everything You Need To Accurately And Efficiently Complete Your Tax Return.

The purpose of this worksheet is to help you organize your tax deductible business expenses. Previous year’s tax return—up to 3 years prior for both state and federal accounting journals and ledgers financial statements—specifically your. Visit business structures for structure specific forms and publications recommendations. In order for an expense to be deductible, it must.