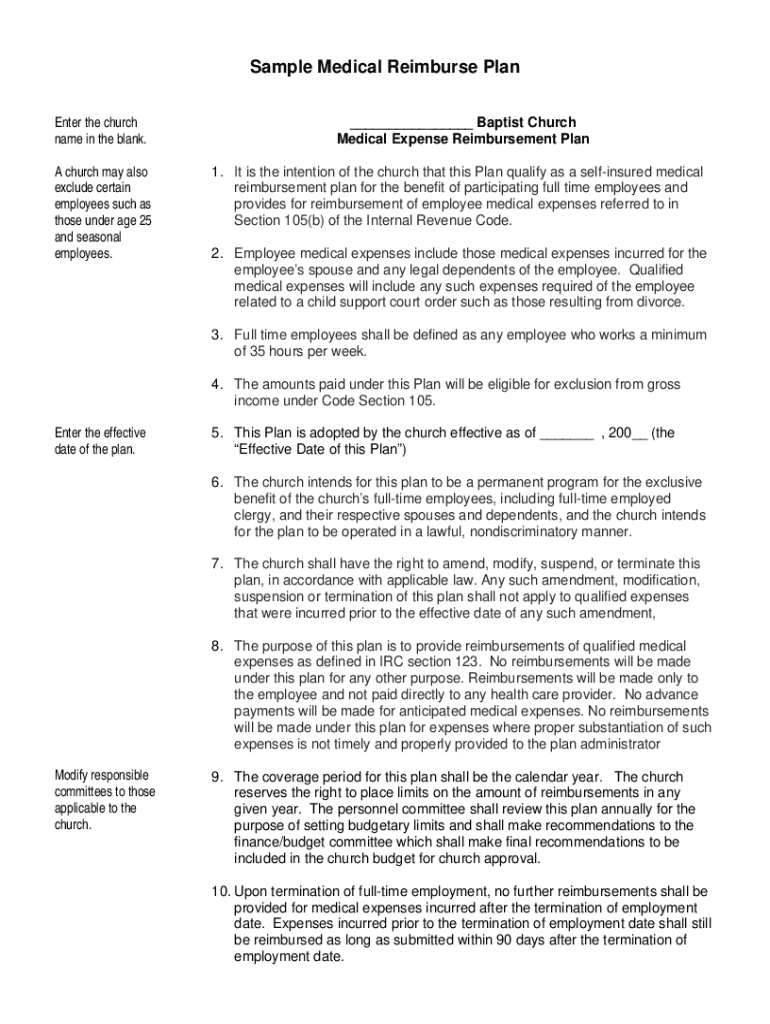

Section 105 Plan Template - The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The section 105 plan turns personal medical expenses into business deductions. The employer hereby adopts (as a participating signatory company) this plan. The plan, when designed for spouses, reimburses employee. “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. 105 employee welfare benefit master plan (the “plan”), is as follows:

The employer hereby adopts (as a participating signatory company) this plan. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The plan, when designed for spouses, reimburses employee. “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The section 105 plan turns personal medical expenses into business deductions. 105 employee welfare benefit master plan (the “plan”), is as follows:

The section 105 plan turns personal medical expenses into business deductions. The plan, when designed for spouses, reimburses employee. 105 employee welfare benefit master plan (the “plan”), is as follows: The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The employer hereby adopts (as a participating signatory company) this plan.

Section 105 Medical Reimbursement Plan Template Printable Word Searches

The employer hereby adopts (as a participating signatory company) this plan. The plan, when designed for spouses, reimburses employee. “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The section 105 plan turns personal medical expenses into business deductions. The plan shall reimburse eligible employees for the cost of.

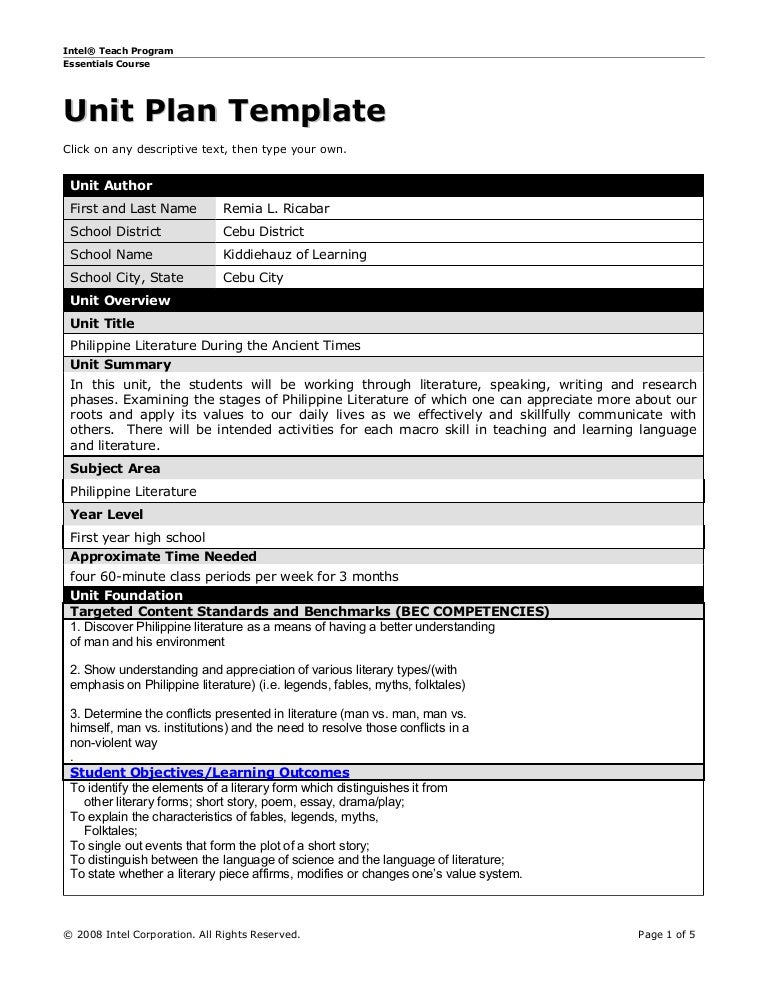

Section 105 Plan Template

The employer hereby adopts (as a participating signatory company) this plan. The plan, when designed for spouses, reimburses employee. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The section 105 plan turns personal medical expenses into business deductions. 105 employee welfare benefit master plan (the.

Section 105 Plan Template

The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The section 105 plan turns personal medical expenses into business deductions. The employer hereby adopts (as a.

Section 105 Plan Template

The plan, when designed for spouses, reimburses employee. 105 employee welfare benefit master plan (the “plan”), is as follows: The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The section 105 plan turns personal medical expenses into business deductions. “medical care” for the section 105 plan.

A Guide to Section 105 Plans Section 105 Plans for Dummies

105 employee welfare benefit master plan (the “plan”), is as follows: The plan, when designed for spouses, reimburses employee. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The employer hereby adopts (as a participating signatory company) this plan. “medical care” for the section 105 plan.

Section 105 Plan Template

The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The plan, when designed for spouses, reimburses employee. The section 105 plan turns personal medical expenses into business deductions. The employer hereby adopts (as a participating signatory company) this plan. 105 employee welfare benefit master plan (the.

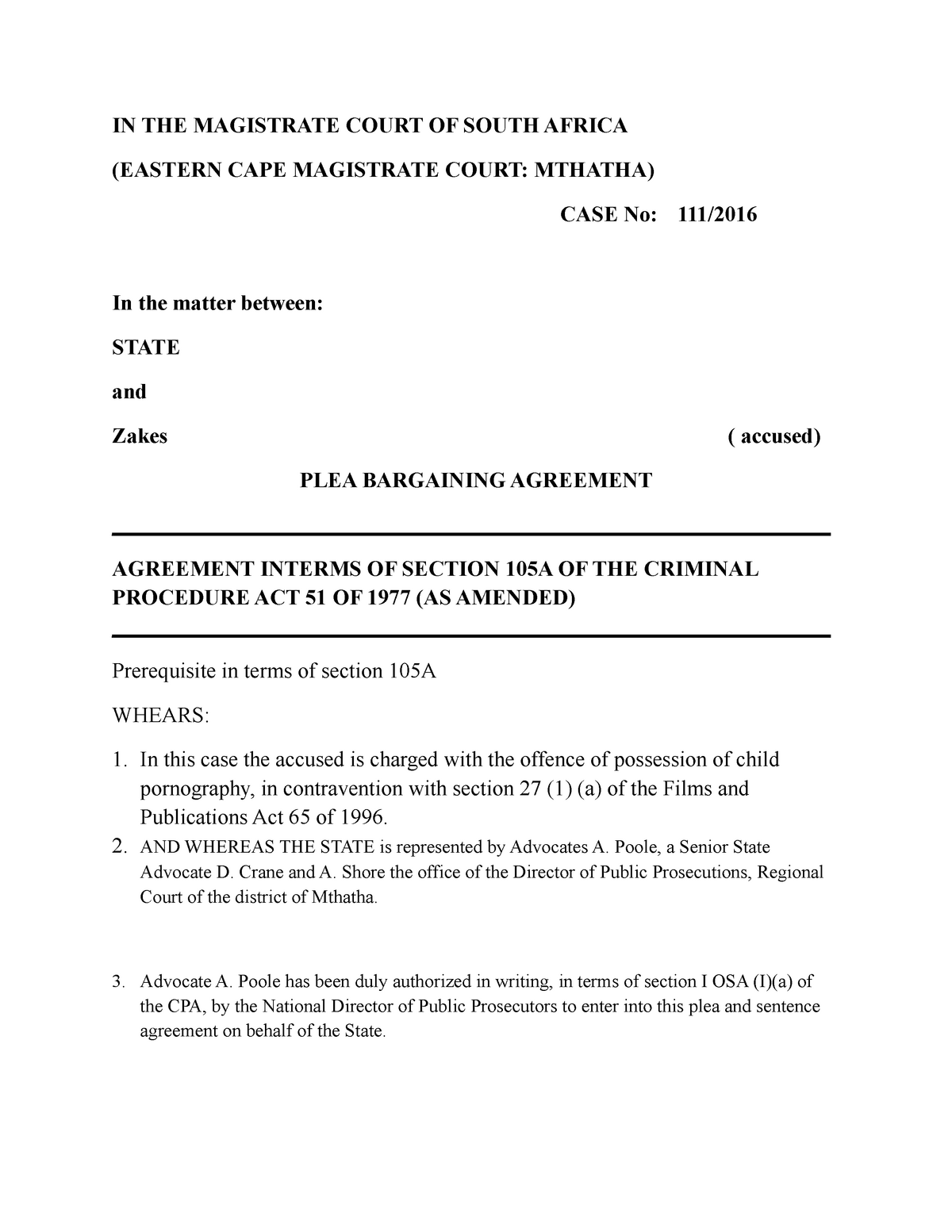

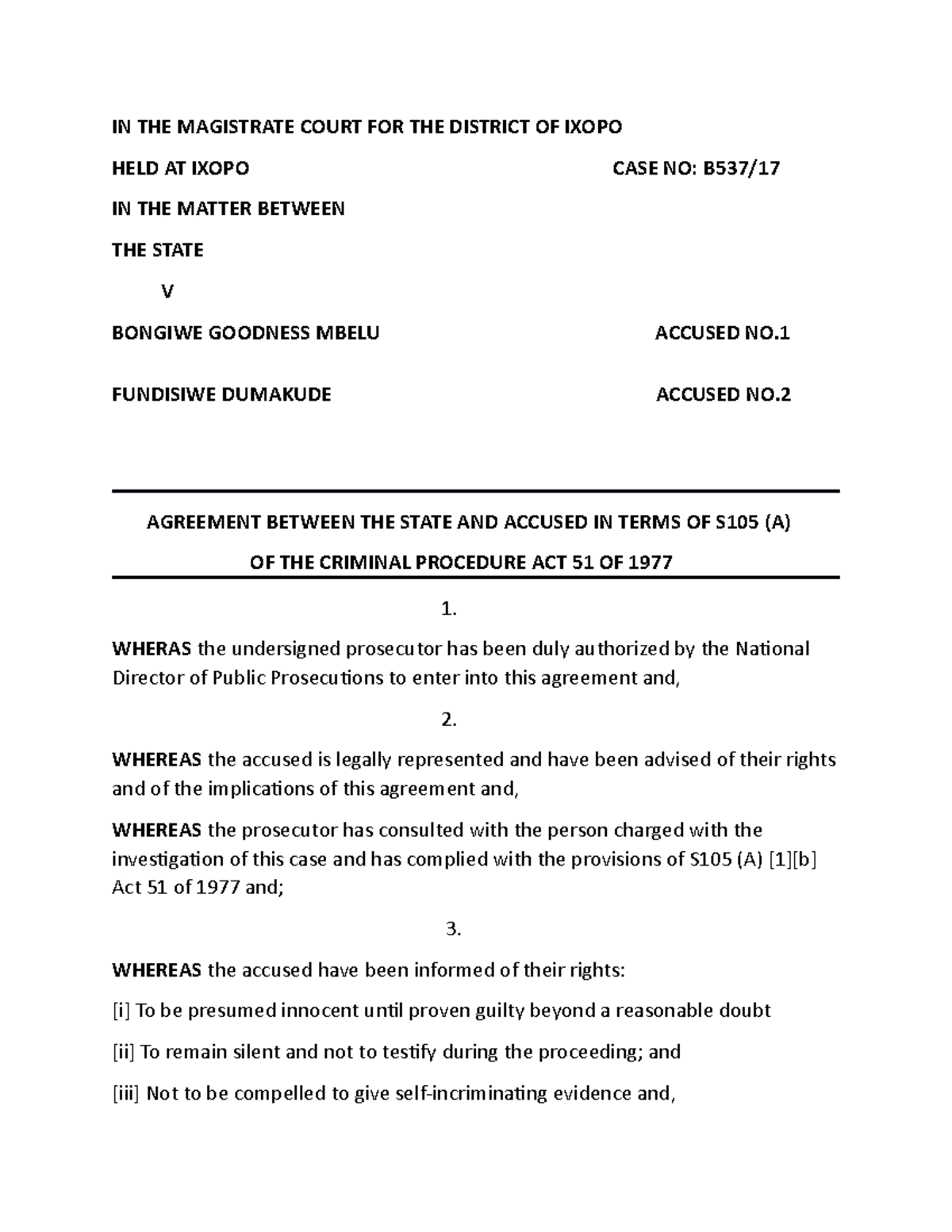

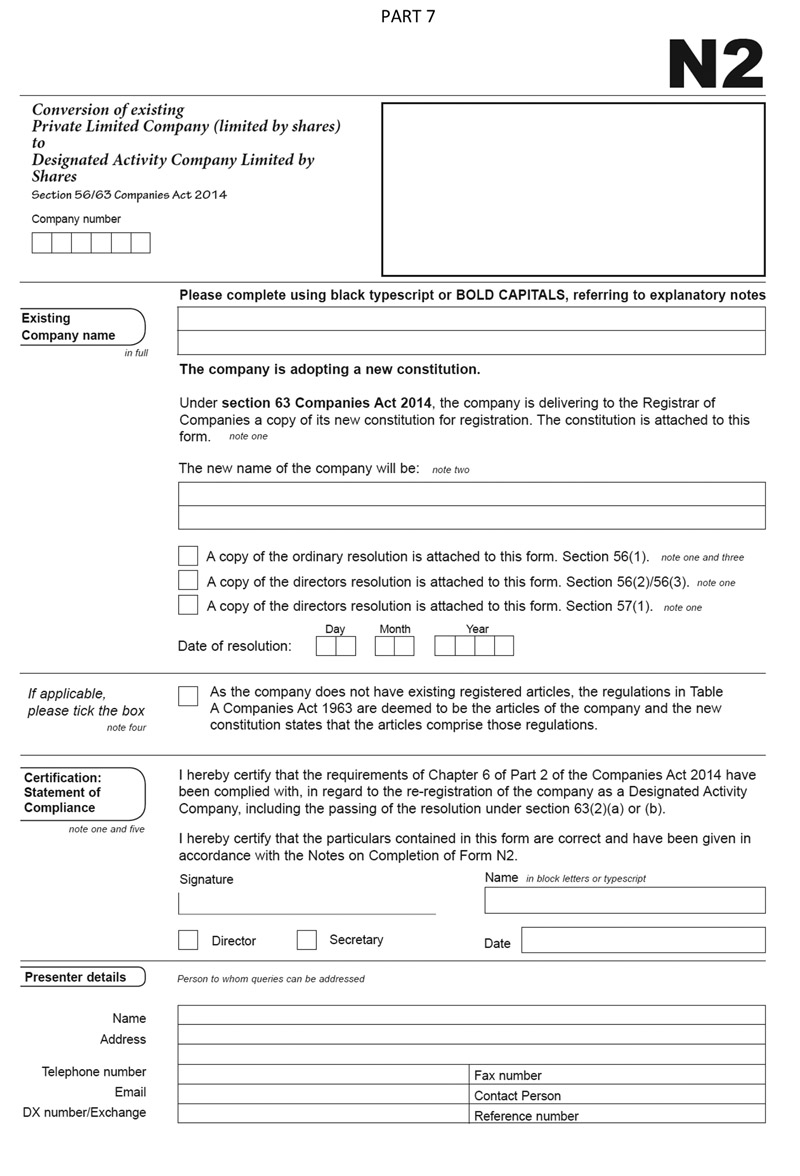

Section 105 Plan How to 'Legally' Set Up + IRS Document Doc Template

105 employee welfare benefit master plan (the “plan”), is as follows: “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The plan, when designed for spouses, reimburses employee. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code.

Section 105 Plan Template

“medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The section 105 plan turns personal medical expenses into business deductions. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The plan, when designed for spouses,.

Section 105 Plan Template

“medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The employer hereby adopts (as a participating signatory company) this plan. The plan, when designed for spouses,.

Section 105 Medical Reimbursement Plan Template Fill Online

“medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. 105 employee welfare benefit master plan (the “plan”), is as follows: The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. The plan, when designed for spouses,.

105 Employee Welfare Benefit Master Plan (The “Plan”), Is As Follows:

The plan shall reimburse eligible employees for the cost of eligible medical and dental expenses, as defined under internal revenue code section 213,. “medical care” for the section 105 plan is defined in section 213(d), which is the section that authorizes itemized deductions. The section 105 plan turns personal medical expenses into business deductions. The plan, when designed for spouses, reimburses employee.