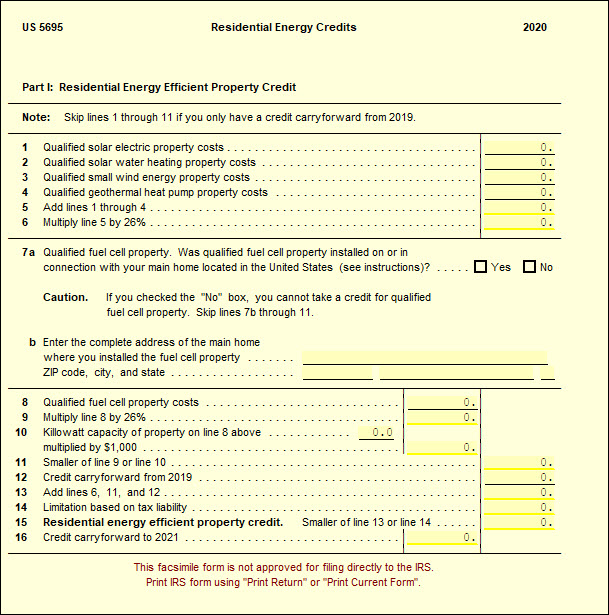

Residential Energy Efficient Property Credit Limit Worksheet - The residential energy efficient property credit is now the residential clean energy credit. $150 for any qualified natural gas, propane, or. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan; The credit rate for property placed in service in 2022 through. Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return.

Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. The credit rate for property placed in service in 2022 through. The residential energy efficient property credit is now the residential clean energy credit. $150 for any qualified natural gas, propane, or. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan; Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return.

Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return. Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. The credit rate for property placed in service in 2022 through. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. $150 for any qualified natural gas, propane, or. The residential energy efficient property credit is now the residential clean energy credit. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan;

Residential Energy Efficient Property Credit Limit Worksheet

$150 for any qualified natural gas, propane, or. Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. The residential energy efficient property credit is now the residential clean energy credit. The credit rate for property placed in service in 2022 through. • the maximum credit for.

Residential Clean Energy Credit Limit Worksheet 2023 Credit

The residential energy efficient property credit is now the residential clean energy credit. Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. $150 for any qualified natural gas, propane, or. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how.

E Residential Energy Efficient Property Credit Limit Worksheet worksheeta

The credit rate for property placed in service in 2022 through. $150 for any qualified natural gas, propane, or. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan; The residential energy efficient property credit is now the residential clean energy credit. Information about form 5695, residential energy credits, including recent updates,.

Residential Energy Efficient Property Credit Limit Worksheet —

Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. $150 for any qualified natural gas, propane, or. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan; The residential energy efficient property credit is now the residential clean.

45L The Energy Efficient Home Credit Extended through 2017

Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return. $150 for any qualified natural gas, propane, or. The credit rate for property placed in service in 2022 through. The residential energy.

5695 Residential Energy Credits UltimateTax Solution Center

Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan; $150 for any qualified natural gas, propane, or. Residential energy credits as a stand alone tax form calculator to.

Energy Efficient Home Improvement Credit Limit Worksheet walkthrough

Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

Residential Clean Energy Credit Limit Worksheet 2023 Credit

Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan; Form 5695, also known.

Energy Efficient Home Improvement Credit Limit Worksheet

The residential energy efficient property credit is now the residential clean energy credit. $150 for any qualified natural gas, propane, or. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return. Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits.

Residential Energy Efficient Property Credit Limit Worksheet —

• the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan; Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy. The credit rate for property placed in service in 2022 through. The residential energy efficient property credit is now.

The Credit Rate For Property Placed In Service In 2022 Through.

The residential energy efficient property credit is now the residential clean energy credit. $150 for any qualified natural gas, propane, or. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. • the maximum credit for residential energy property costs is $50 for any advanced main air circulating fan;

Residential Energy Credits As A Stand Alone Tax Form Calculator To Quickly Calculate Specific Amounts For Your 2025 Tax Return.

Form 5695, also known as residential energy credits, is a crucial irs form that allows taxpayers to claim credits for qualified residential energy.