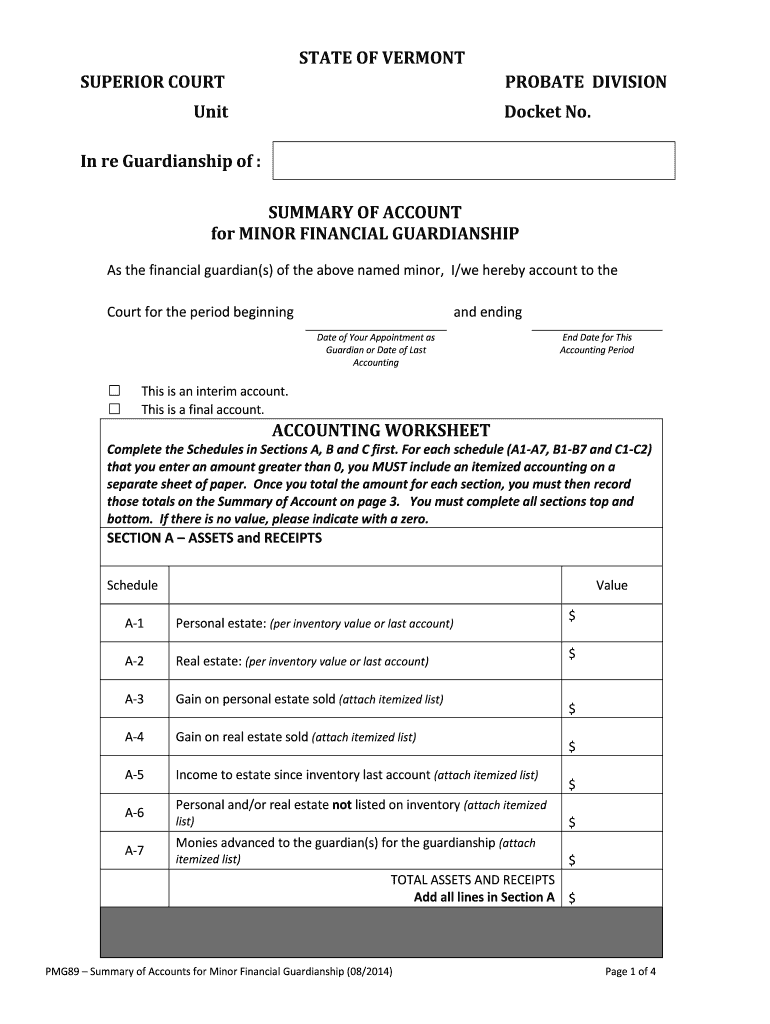

Probate Accounting Template - Objections to the accounting should be written and filed no later than thirty (30) days after. With a probate accounting excel template, you can record and calculate estate assets, track. Click here for our excel estate accounting sample without examples.

Click here for our excel estate accounting sample without examples. With a probate accounting excel template, you can record and calculate estate assets, track. Objections to the accounting should be written and filed no later than thirty (30) days after.

Click here for our excel estate accounting sample without examples. Objections to the accounting should be written and filed no later than thirty (30) days after. With a probate accounting excel template, you can record and calculate estate assets, track.

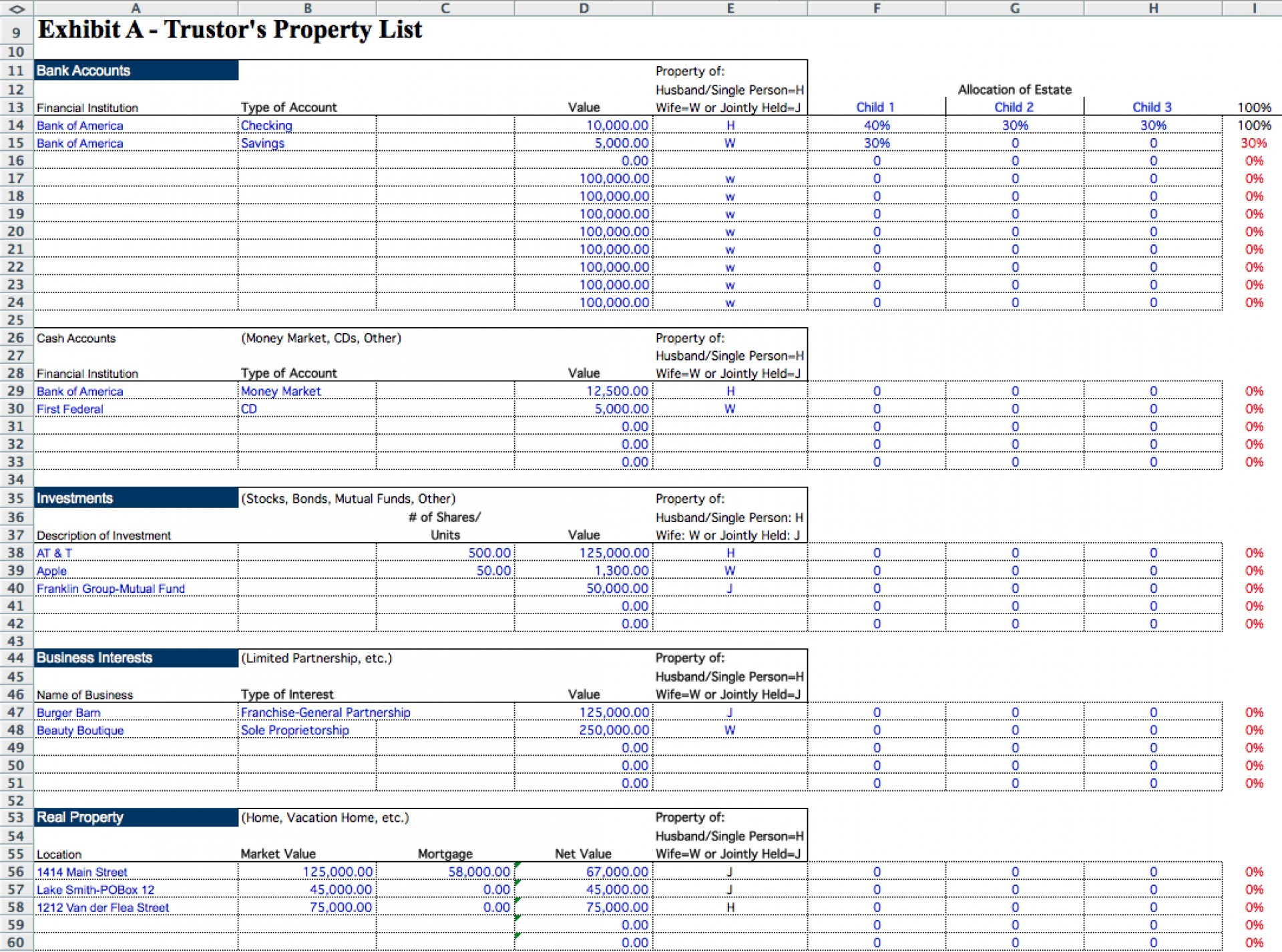

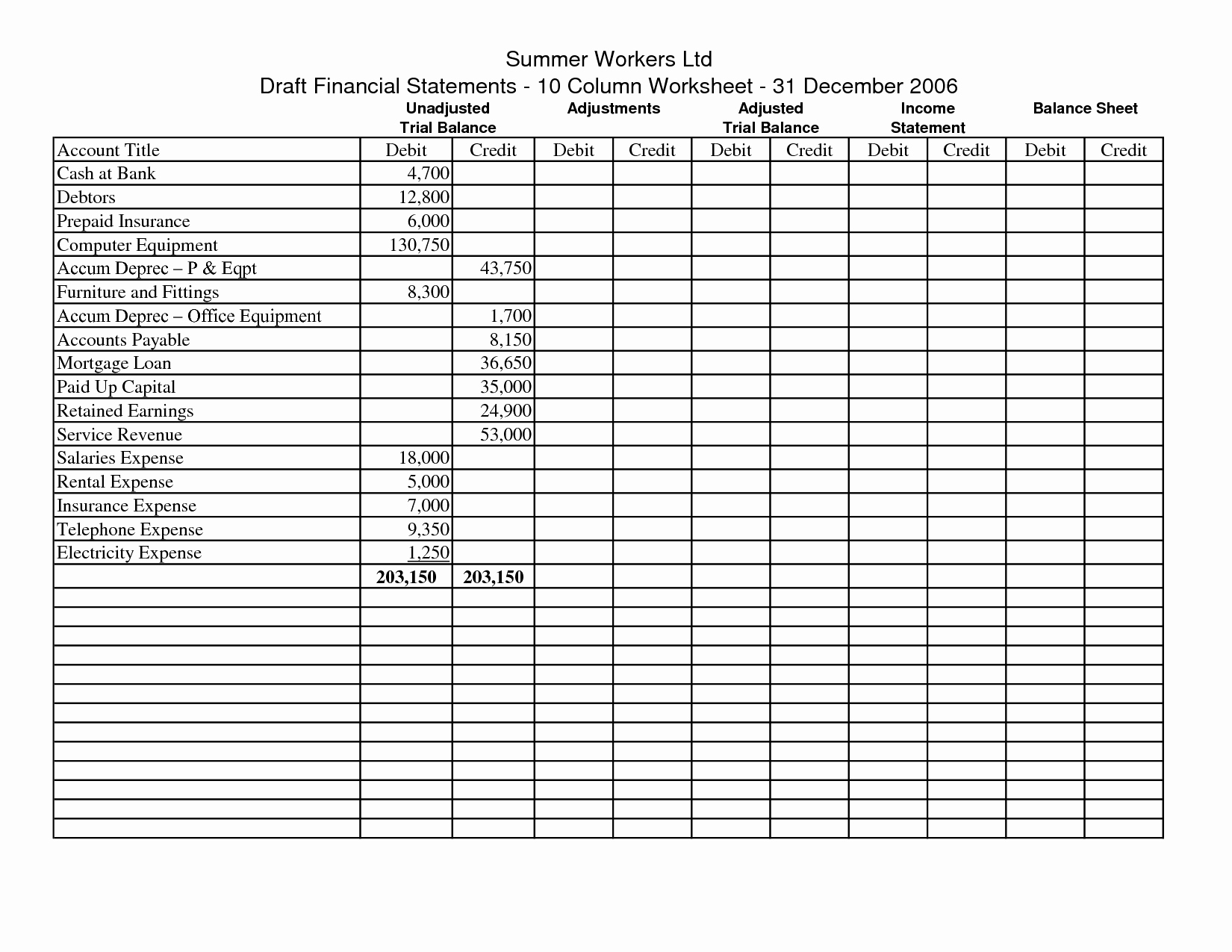

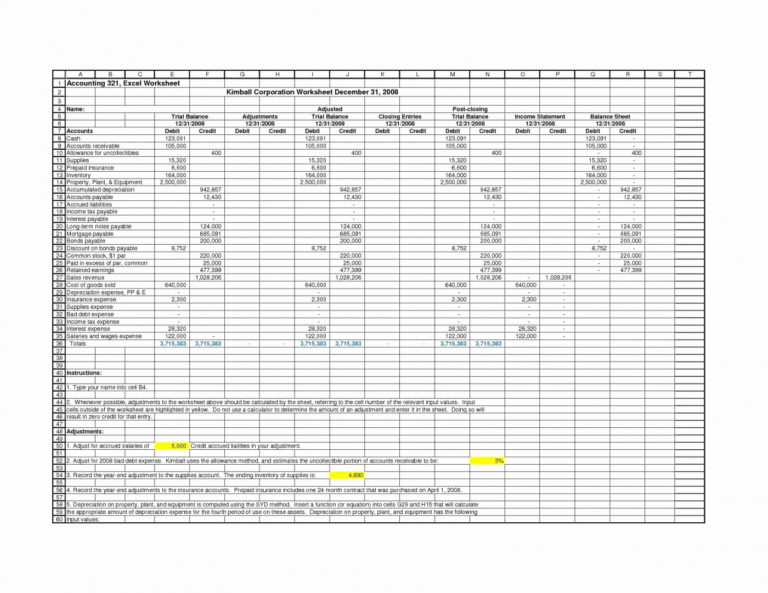

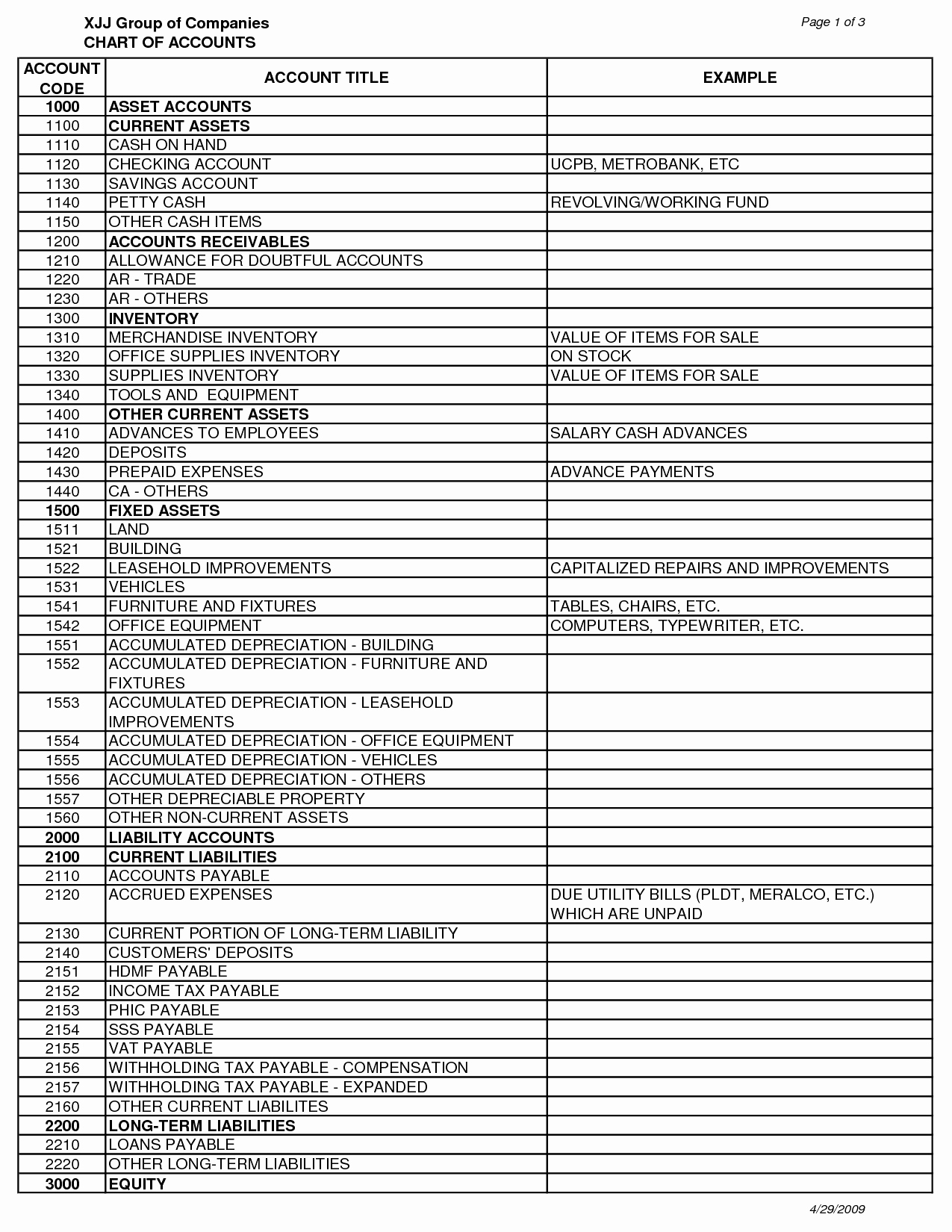

Probate Accounting Template Excel Excel spreadsheets templates

Objections to the accounting should be written and filed no later than thirty (30) days after. With a probate accounting excel template, you can record and calculate estate assets, track. Click here for our excel estate accounting sample without examples.

Probate Accounting Template Excel

Objections to the accounting should be written and filed no later than thirty (30) days after. With a probate accounting excel template, you can record and calculate estate assets, track. Click here for our excel estate accounting sample without examples.

Probate Spreadsheet Template —

Click here for our excel estate accounting sample without examples. With a probate accounting excel template, you can record and calculate estate assets, track. Objections to the accounting should be written and filed no later than thirty (30) days after.

Probate Accounting Spreadsheet Inspirational Spreadsheet Probate within

With a probate accounting excel template, you can record and calculate estate assets, track. Click here for our excel estate accounting sample without examples. Objections to the accounting should be written and filed no later than thirty (30) days after.

Probate Accounting Template California prntbl.concejomunicipaldechinu

With a probate accounting excel template, you can record and calculate estate assets, track. Click here for our excel estate accounting sample without examples. Objections to the accounting should be written and filed no later than thirty (30) days after.

Probate Accounting Spreadsheet For 005 Probate Accounting Template

With a probate accounting excel template, you can record and calculate estate assets, track. Click here for our excel estate accounting sample without examples. Objections to the accounting should be written and filed no later than thirty (30) days after.

Probate Accounting Template Excel New Probate Accounting Template and

With a probate accounting excel template, you can record and calculate estate assets, track. Click here for our excel estate accounting sample without examples. Objections to the accounting should be written and filed no later than thirty (30) days after.

Probate Accounting Template

Objections to the accounting should be written and filed no later than thirty (30) days after. Click here for our excel estate accounting sample without examples. With a probate accounting excel template, you can record and calculate estate assets, track.

Probate Accounting Template Excel

With a probate accounting excel template, you can record and calculate estate assets, track. Objections to the accounting should be written and filed no later than thirty (30) days after. Click here for our excel estate accounting sample without examples.

Probate Spreadsheet Template Google Spreadshee probate spreadsheet

Objections to the accounting should be written and filed no later than thirty (30) days after. Click here for our excel estate accounting sample without examples. With a probate accounting excel template, you can record and calculate estate assets, track.

With A Probate Accounting Excel Template, You Can Record And Calculate Estate Assets, Track.

Click here for our excel estate accounting sample without examples. Objections to the accounting should be written and filed no later than thirty (30) days after.