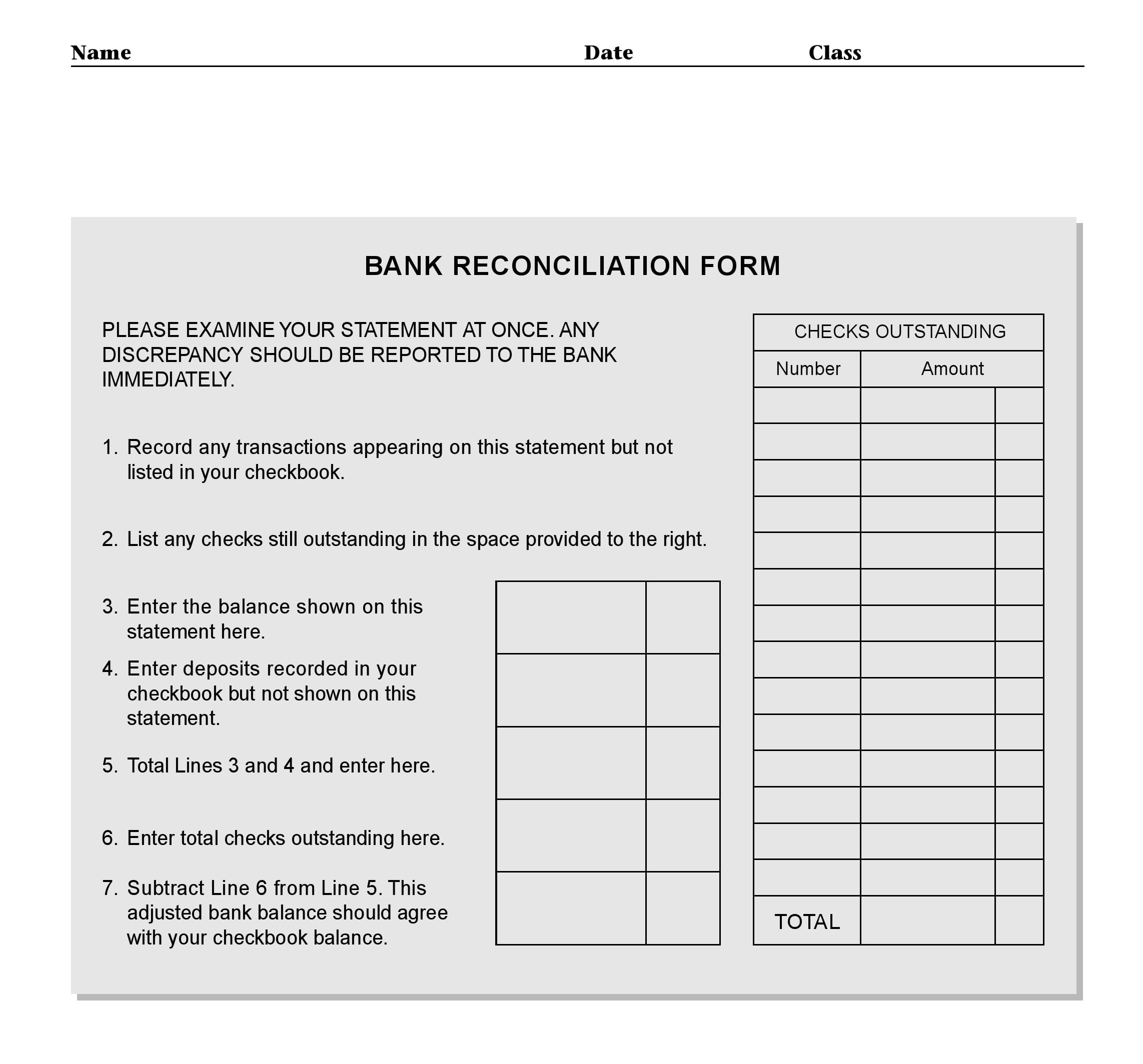

Printable Bank Reconciliation Form - Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account.

A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

20+ Free Bank Reconciliation Sheet Templates Printable Samples

A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

Free Bank Reconciliation Form PDF Template Form Download

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account.

50+ Bank Reconciliation Examples & Templates [100 Free]

A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

55 Useful Bank Reconciliation Template RedlineSP

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account.

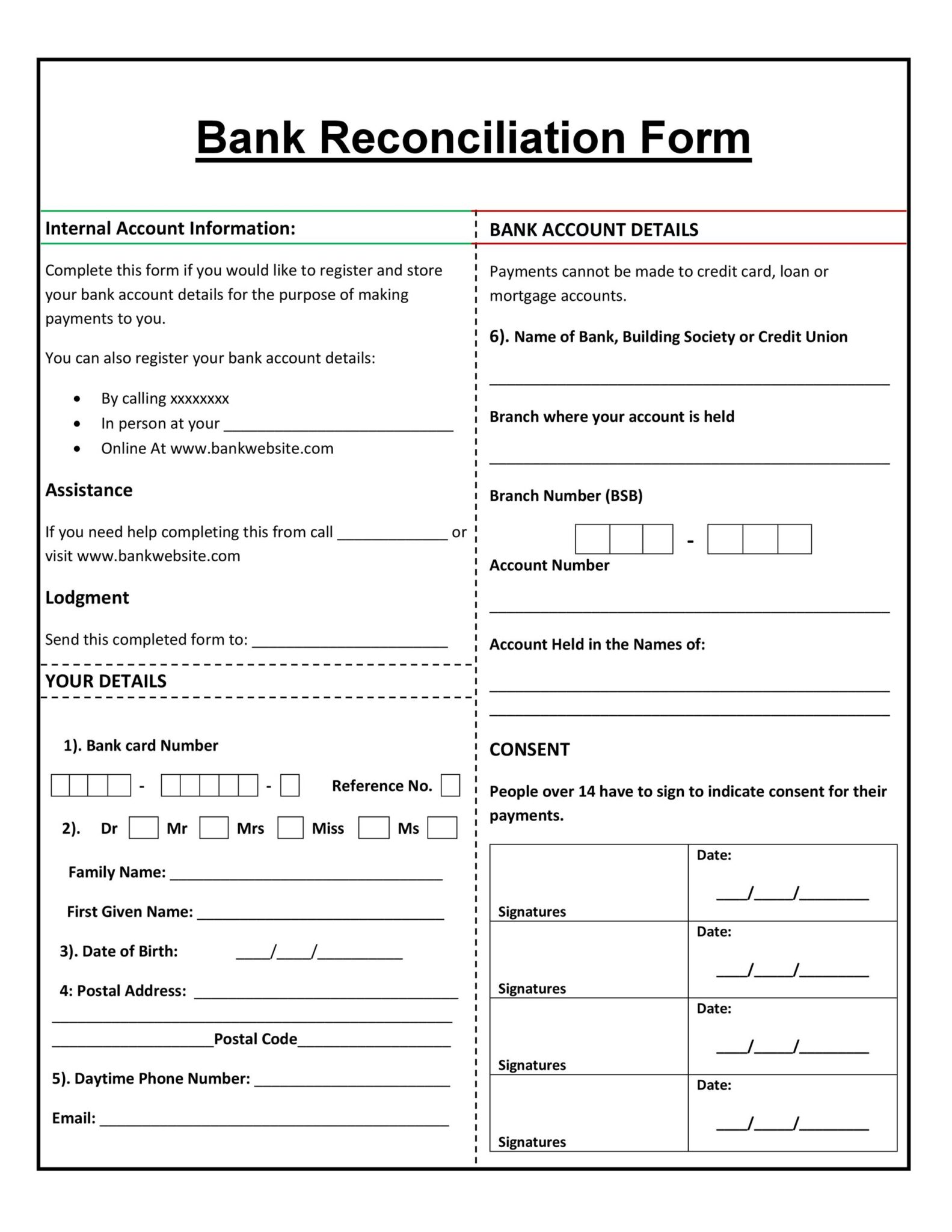

Checking Account Reconciliation Form printable pdf download

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account.

10+ Bank Reconciliation Template Get Free Documents (Excel, PDF)

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account.

50+ Bank Reconciliation Examples & Templates [100 Free]

A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

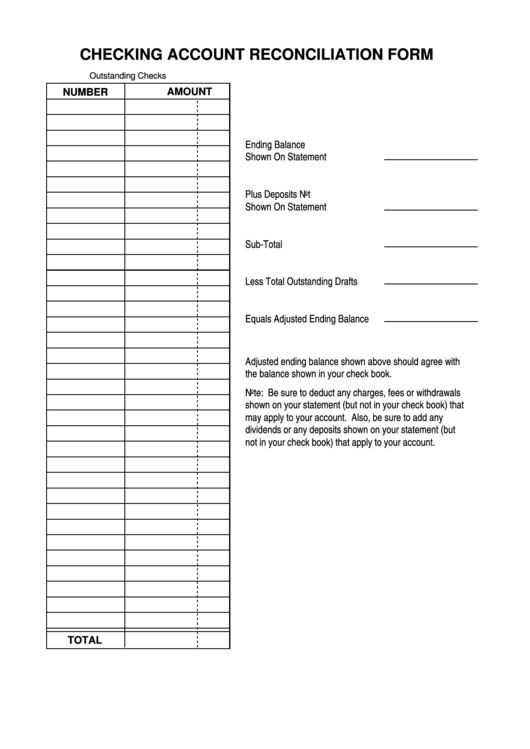

50+ Bank Reconciliation Examples & Templates [100 Free]

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account. A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account.

50+ Bank Reconciliation Examples & Templates [100 Free]

A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

50+ Bank Reconciliation Examples & Templates [100 Free]

A bank reconciliation form records the deposits and checks for calculating the reconciling amount between the bank and the company’s account. Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

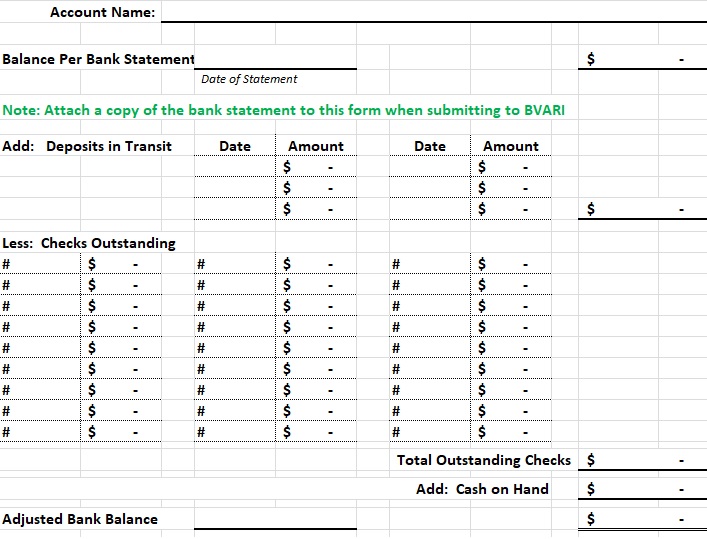

A Bank Reconciliation Form Records The Deposits And Checks For Calculating The Reconciling Amount Between The Bank And The Company’s Account.

Be sure to deduct any charges, fees or withdrawals shown on your statement (but not in your check book) that may apply to your account.

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-17.jpg?w=320)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-21.jpg?w=320)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-07.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-12.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-40.jpg)