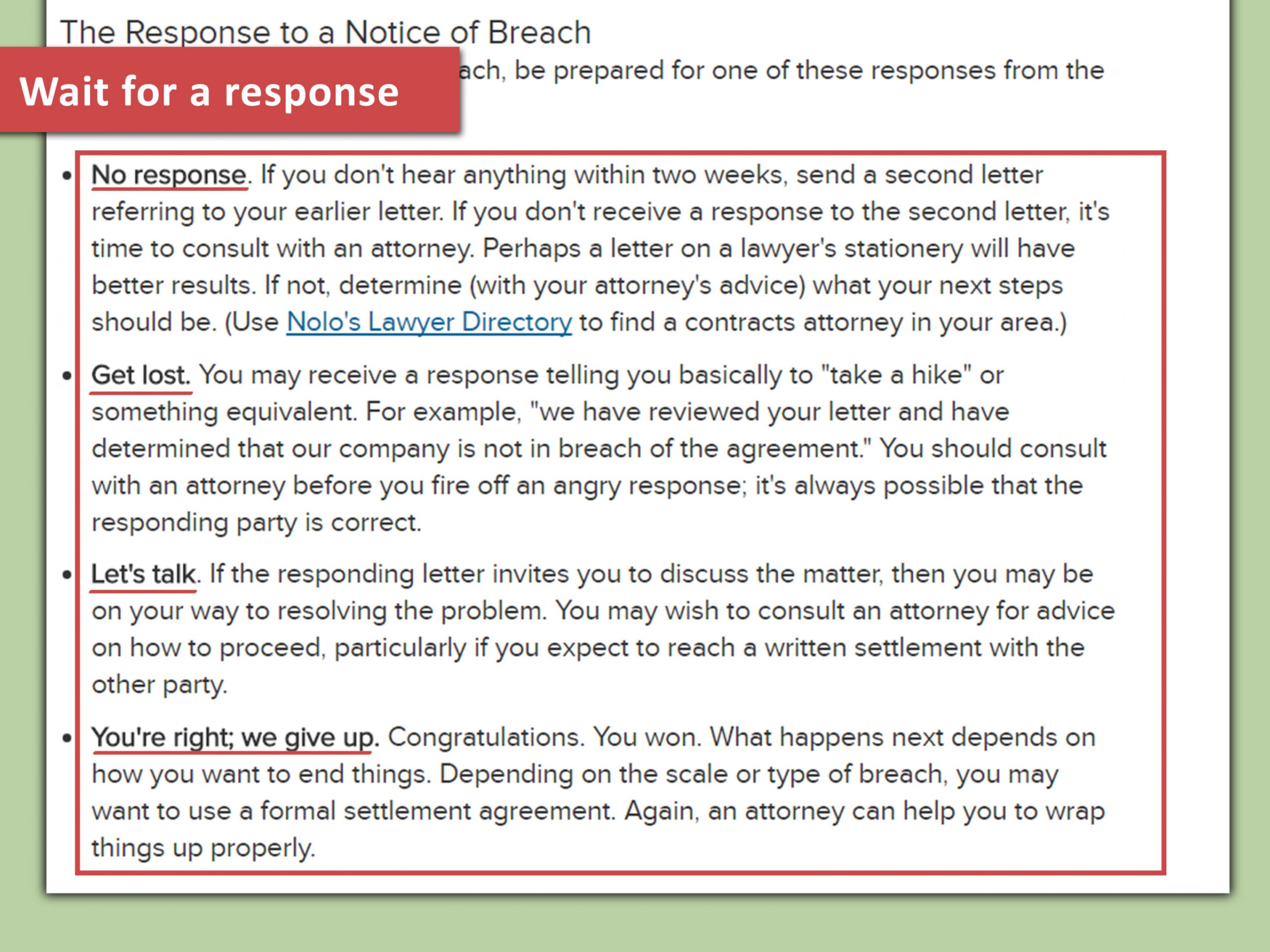

Irs B Notice Template - Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. Identify which irs notice you received; You must have the irs or ssa validate. If the notice and your records match, send the appropriate b notice to the payee.

Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. You must have the irs or ssa validate. Identify which irs notice you received; If the notice and your records match, send the appropriate b notice to the payee.

Identify which irs notice you received; If the notice and your records match, send the appropriate b notice to the payee. Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. You must have the irs or ssa validate.

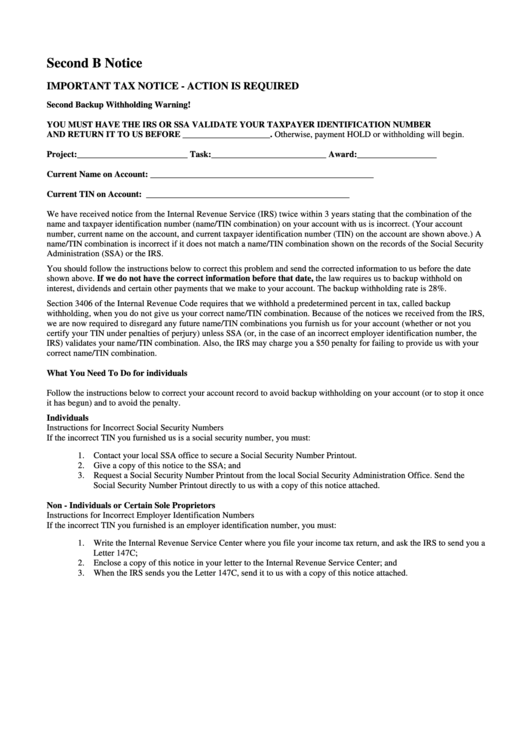

Second B Notice Important Tax Notice Action Is Required printable

If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate. Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. Identify which irs notice you received;

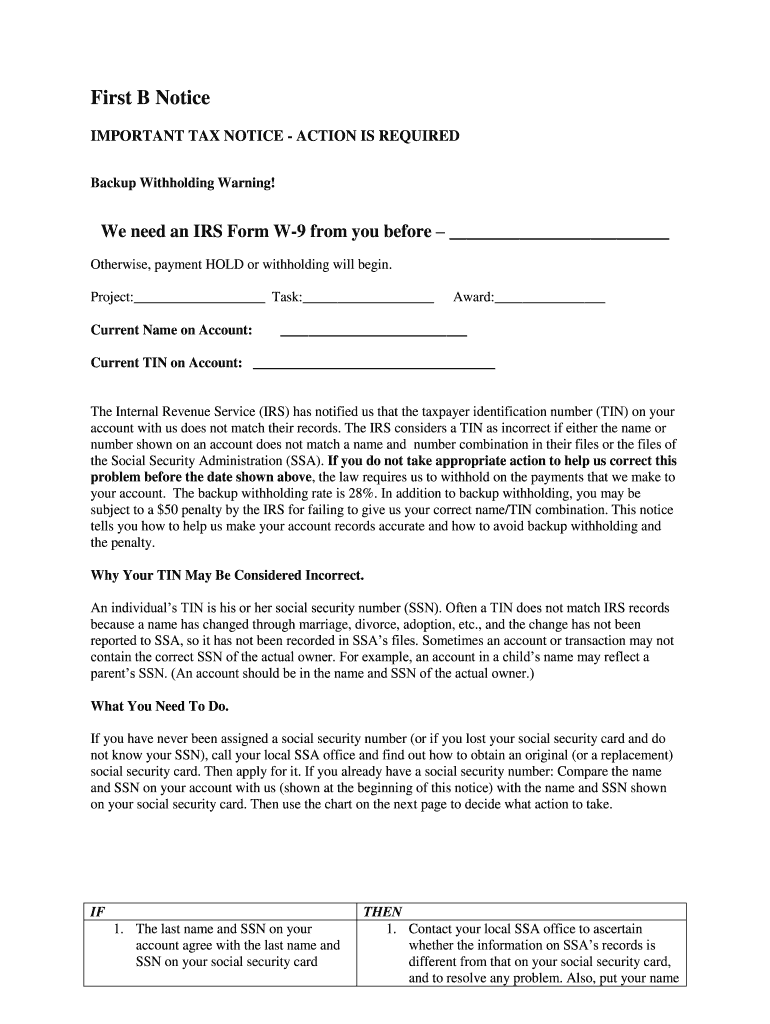

B Notice Letter Fill Online, Printable, Fillable, Blank pdfFiller

If the notice and your records don’t match, this could be. You must have the irs or ssa validate. Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records match, send the appropriate b notice to the payee. Identify which irs notice you received;

IRS Audit Letter 2205B Sample 2

If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate. Identify which irs notice you received; Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be.

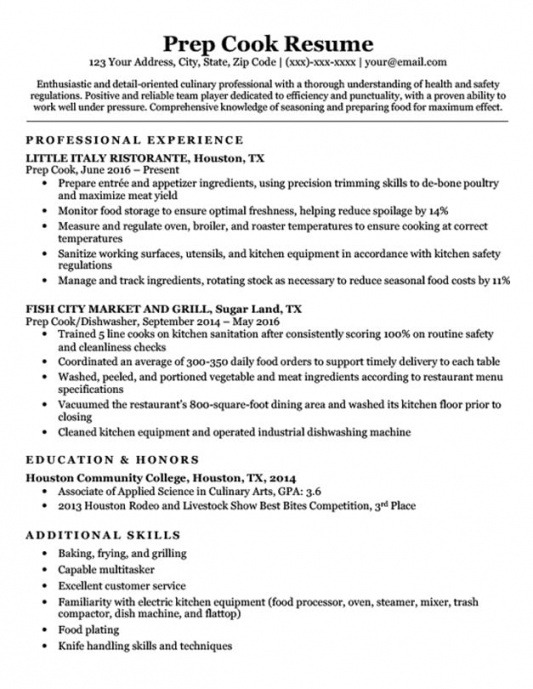

Irs B Notice Template

If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate. If the notice and your records don’t match, this could be. Compare your records with the list of incorrect tins or name/tin combinations. Identify which irs notice you received;

Sample Irs Notice Cp2000

If the notice and your records don’t match, this could be. You must have the irs or ssa validate. Compare your records with the list of incorrect tins or name/tin combinations. Identify which irs notice you received; If the notice and your records match, send the appropriate b notice to the payee.

First B Notice Template Irs Example Tacitproject

Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. Identify which irs notice you received; You must have the irs or ssa validate. If the notice and your records match, send the appropriate b notice to the payee.

Irs B Notice Template

Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate. Identify which irs notice you received;

Show Me A Completed B Notice From The Irs Flash Sales

Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate. Identify which irs notice you received;

Irs First B Notice Template Doc Tacitproject

Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. You must have the irs or ssa validate. If the notice and your records match, send the appropriate b notice to the payee. Identify which irs notice you received;

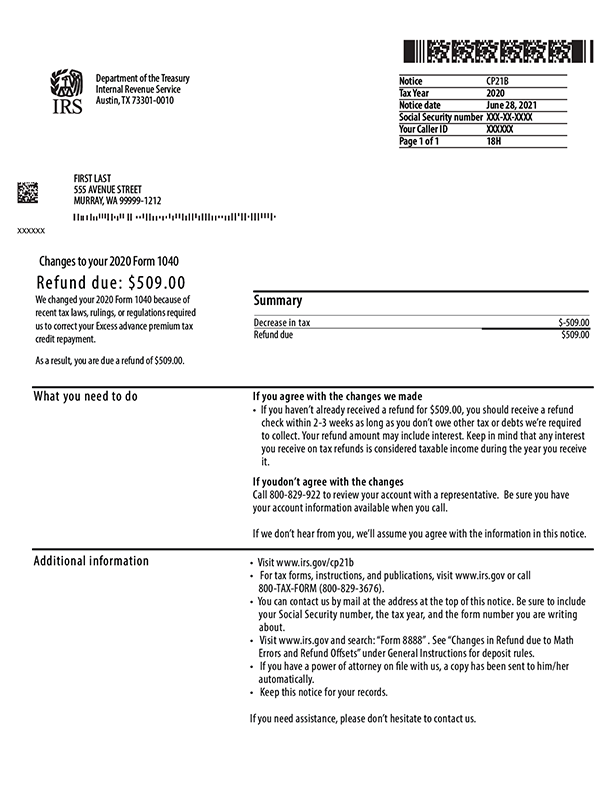

All about IRS Notice CP21B Refund Status

You must have the irs or ssa validate. Identify which irs notice you received; Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. If the notice and your records match, send the appropriate b notice to the payee.

Compare Your Records With The List Of Incorrect Tins Or Name/Tin Combinations.

You must have the irs or ssa validate. If the notice and your records don’t match, this could be. If the notice and your records match, send the appropriate b notice to the payee. Identify which irs notice you received;