How Much Of My Social Security Is Taxable Worksheet - For modest and low incomes, none of your social. The worksheet provided can be used to determine the exact amount. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Use this calculator to estimate how much of your social security benefit is subject to income taxes. The taxable portion can range from 50 to 85 percent of your benefits.

The taxable portion can range from 50 to 85 percent of your benefits. For modest and low incomes, none of your social. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Use this calculator to estimate how much of your social security benefit is subject to income taxes. The worksheet provided can be used to determine the exact amount.

Use this calculator to estimate how much of your social security benefit is subject to income taxes. For modest and low incomes, none of your social. The worksheet provided can be used to determine the exact amount. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The taxable portion can range from 50 to 85 percent of your benefits.

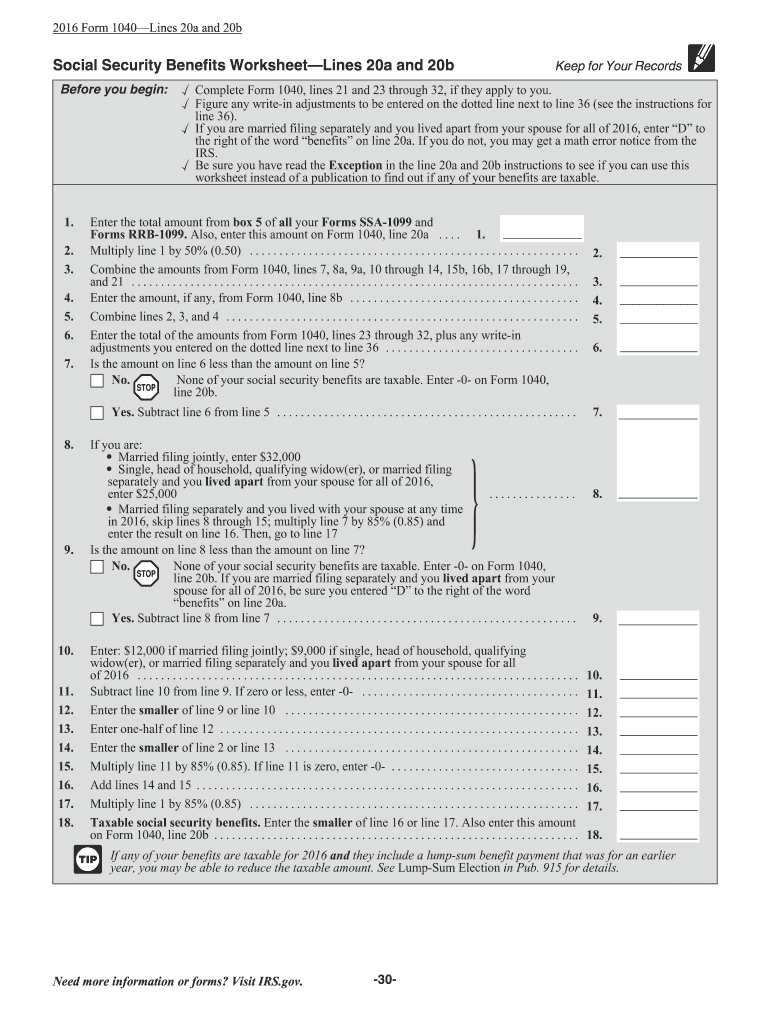

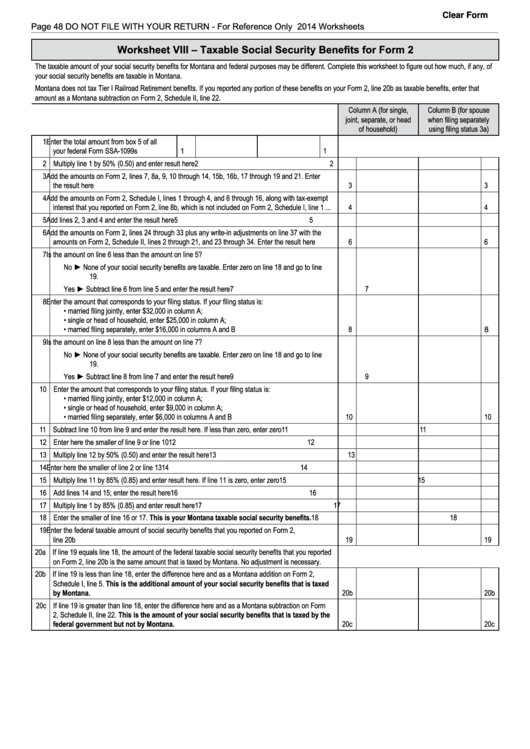

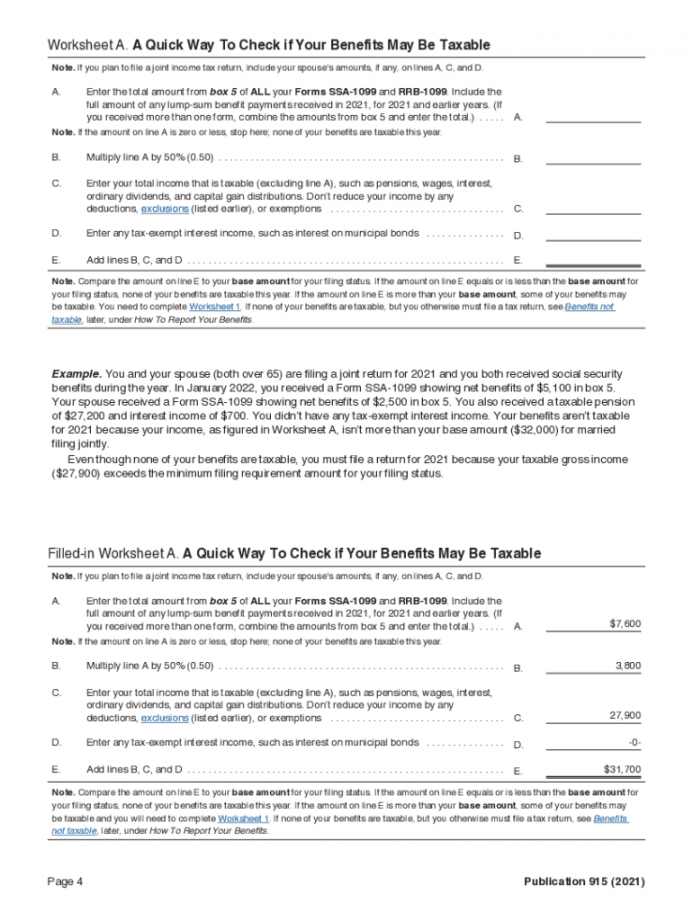

Taxable Social Security Worksheet 2021

The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Use this calculator to estimate how much of your social security benefit is subject to income taxes. For modest and low incomes, none of your social. Complete this worksheet to see if any of your social.

Worksheet For Taxable Social Security

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. Use this calculator to estimate how much of your social security benefit is subject to income.

Taxable Social Security Worksheet 2020

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The taxable portion can range from 50 to 85 percent of your benefits. Use this calculator to estimate how much of your social security benefit is subject to income taxes. The worksheet provided can be used to determine the exact.

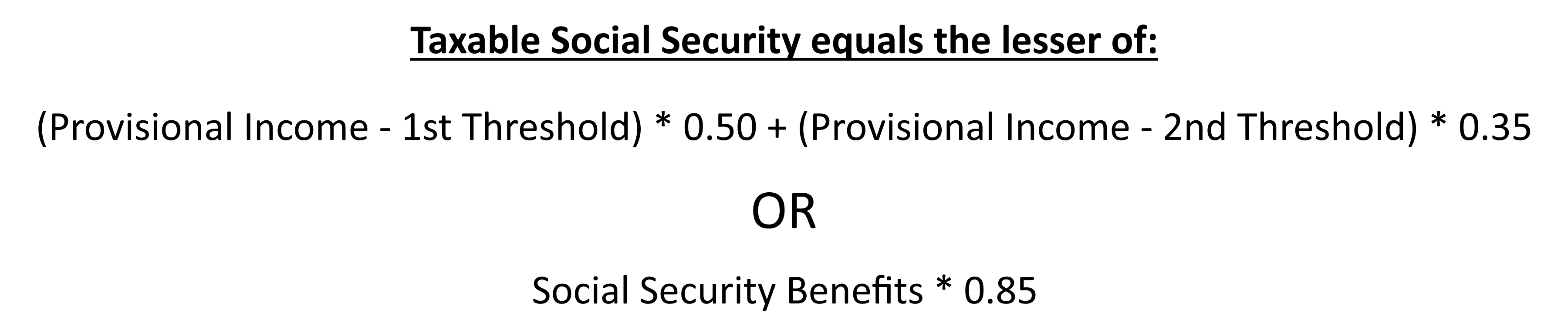

How to Calculate Taxable Social Security (Form 1040, Line 6b) Marotta

Use this calculator to estimate how much of your social security benefit is subject to income taxes. For modest and low incomes, none of your social. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The worksheet provided can be used to determine the exact amount. The taxable portion.

Social Security Taxable Benefits Worksheet

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Use this calculator to estimate how much of your social security benefit is subject to income taxes. For modest and low incomes, none of your social. The taxable portion can range from 50 to 85 percent of your benefits. The.

How To Fill Out Taxable Social Security Worksheet 2023 1040

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. For modest and low incomes, none of your social. The taxable portion can range from 50 to 85 percent of your benefits. Use this calculator to estimate how much of your social security benefit is subject to income taxes. The.

Social Security Taxable Benefits Worksheet 2023 Taxable Soci

The worksheet provided can be used to determine the exact amount. For modest and low incomes, none of your social. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The taxable portion can range from 50 to 85 percent of your benefits. Use this calculator to estimate how much.

Ss Worksheet 2023 Taxable Social Security Worksheets

Use this calculator to estimate how much of your social security benefit is subject to income taxes. For modest and low incomes, none of your social. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. Complete this worksheet to see if any of your social.

Worksheet For Taxable Social Security

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Use this calculator to estimate how much of your social security benefit is subject to income taxes. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your.

Social Security Taxable Worksheet 2022

For modest and low incomes, none of your social. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Use this calculator to estimate how much.

Use This Calculator To Estimate How Much Of Your Social Security Benefit Is Subject To Income Taxes.

The taxable portion can range from 50 to 85 percent of your benefits. For modest and low incomes, none of your social. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The worksheet provided can be used to determine the exact amount.