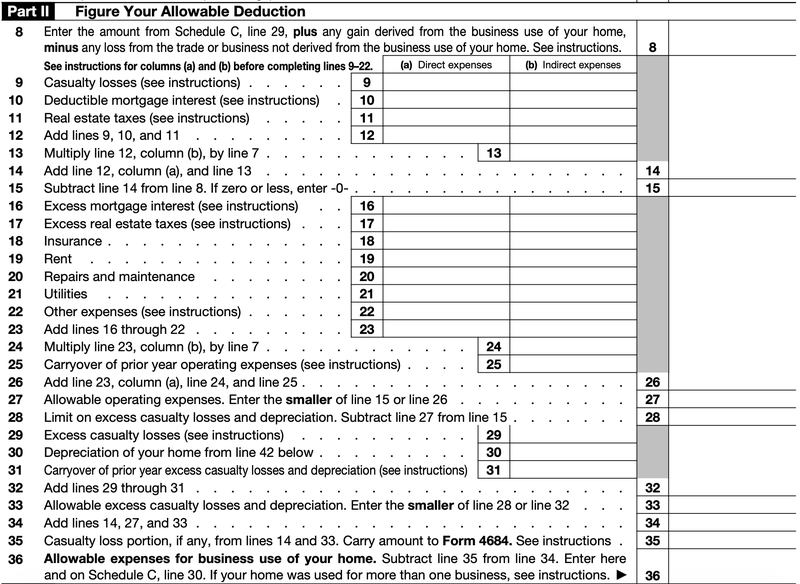

Form 8829 Line 11 Worksheet - Use form 8829 to figure the allowable expenses for business use of your home on schedule c. Information about form 8829, expenses for business use of your home,. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax.

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Information about form 8829, expenses for business use of your home,. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. Use form 8829 to figure the allowable expenses for business use of your home on schedule c.

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Use form 8829 to figure the allowable expenses for business use of your home on schedule c. Information about form 8829, expenses for business use of your home,. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use.

Form 8829 Line 11 Worksheet Instructions

Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Information about form 8829, expenses for business use of your home,. Use form 8829 to figure the allowable expenses for business use of your home.

Form 8829 Line 11 Worksheet Instructions

Information about form 8829, expenses for business use of your home,. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Use form 8829 to figure the allowable expenses for business use of your home.

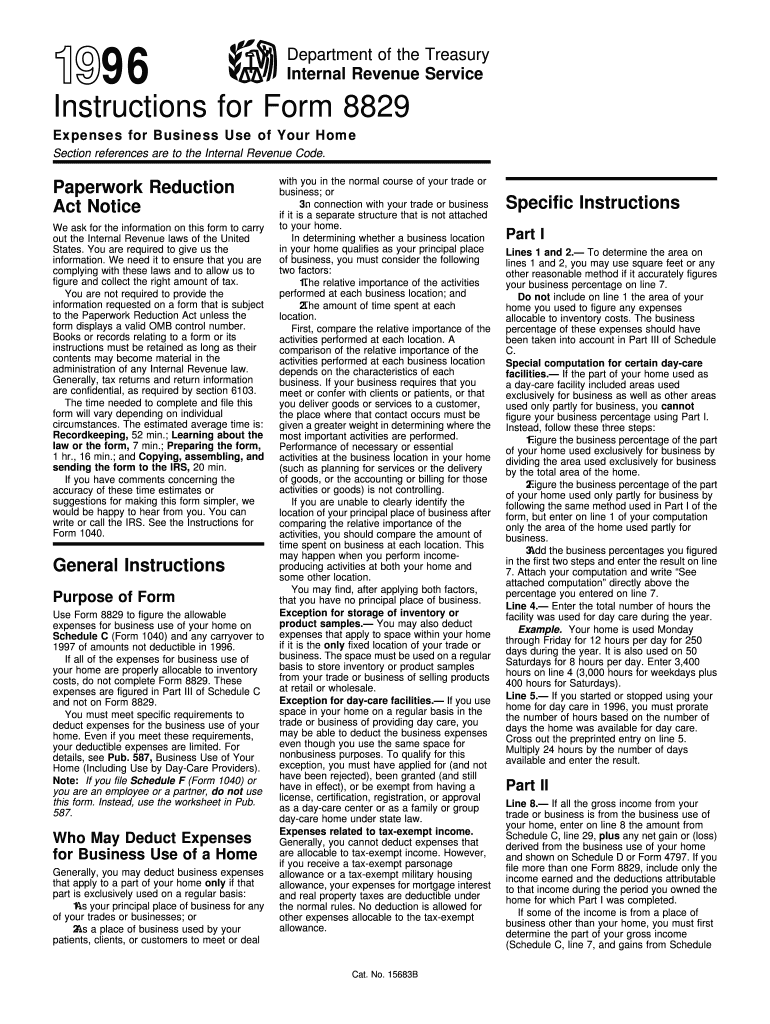

IRS Form 8829 walkthrough (Expenses for Business Use of Your Home

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Use form 8829 to figure the allowable expenses for business use of your home on schedule c. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. Information about form 8829, expenses for business use.

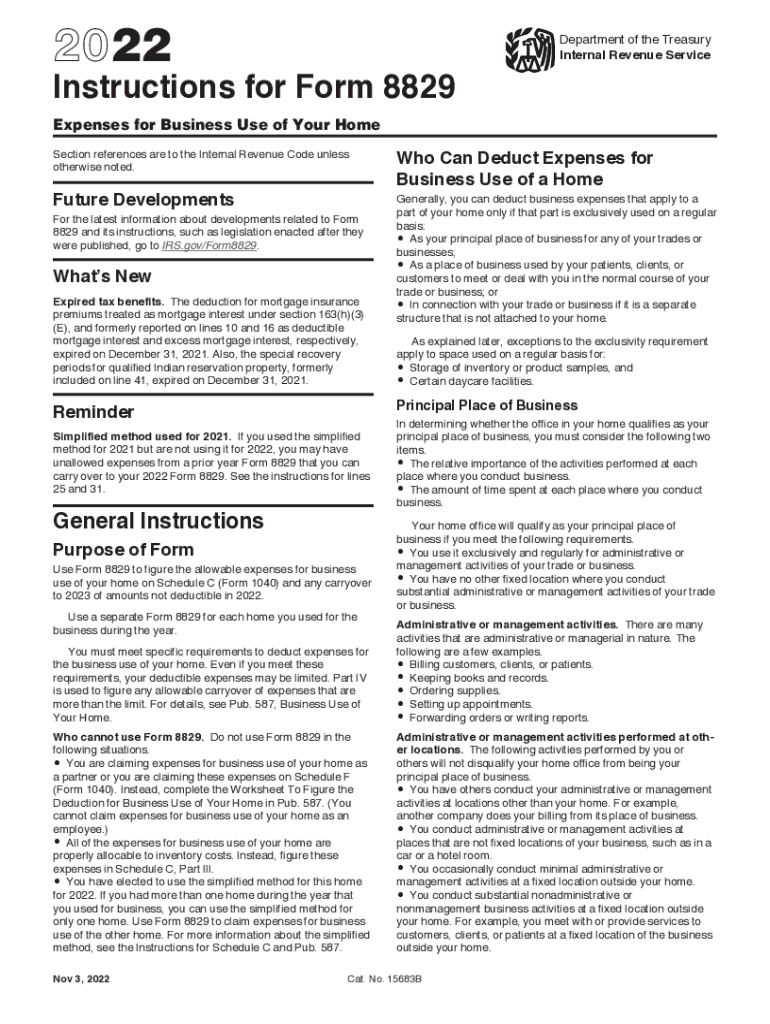

Instructions for 8829 Instructions for Form 8829 Irs Fill Out and

Use form 8829 to figure the allowable expenses for business use of your home on schedule c. Information about form 8829, expenses for business use of your home,. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction.

Form 8829 Line 11 Worksheet Printable Calendars AT A GLANCE

Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. Information about form 8829, expenses for business use of your home,. Use form 8829 to figure the allowable expenses for business use of your home on schedule c. A user asks where to find the input for form 8829 line 11 worksheet.

Form 8829 Line 11 Worksheet Instructions

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Information about form 8829, expenses for business use of your home,. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. Use form 8829 to figure the allowable expenses for business use of your home.

Fillable Online IRS Form 8829 Worksheet Fax Email Print pdfFiller

Information about form 8829, expenses for business use of your home,. Use form 8829 to figure the allowable expenses for business use of your home on schedule c. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. A user asks where to find the input for form 8829 line 11 worksheet.

Form 8829 Line 11 Worksheet Instructions

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Information about form 8829, expenses for business use of your home,. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. Use form 8829 to figure the allowable expenses for business use of your home.

IRS Form 8829 Instructions Figuring Home Business Expenses

A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Information about form 8829, expenses for business use of your home,. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. Use form 8829 to figure the allowable expenses for business use of your home.

Form 8829 Line 11 Worksheet

Use form 8829 to figure the allowable expenses for business use of your home on schedule c. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Add line 7 through 10 multiple line 11(b) by line 6 (pro rata) statutory deduction for business use. Information about form 8829, expenses for business use.

Add Line 7 Through 10 Multiple Line 11(B) By Line 6 (Pro Rata) Statutory Deduction For Business Use.

Information about form 8829, expenses for business use of your home,. A user asks where to find the input for form 8829 line 11 worksheet in lacerte tax. Use form 8829 to figure the allowable expenses for business use of your home on schedule c.