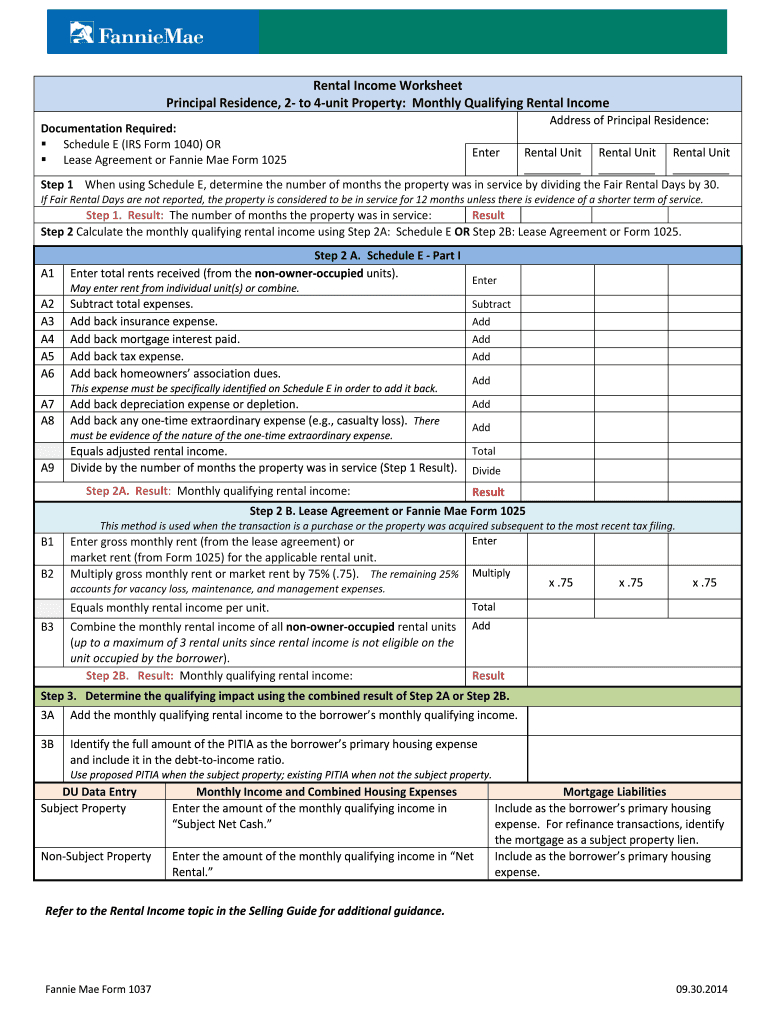

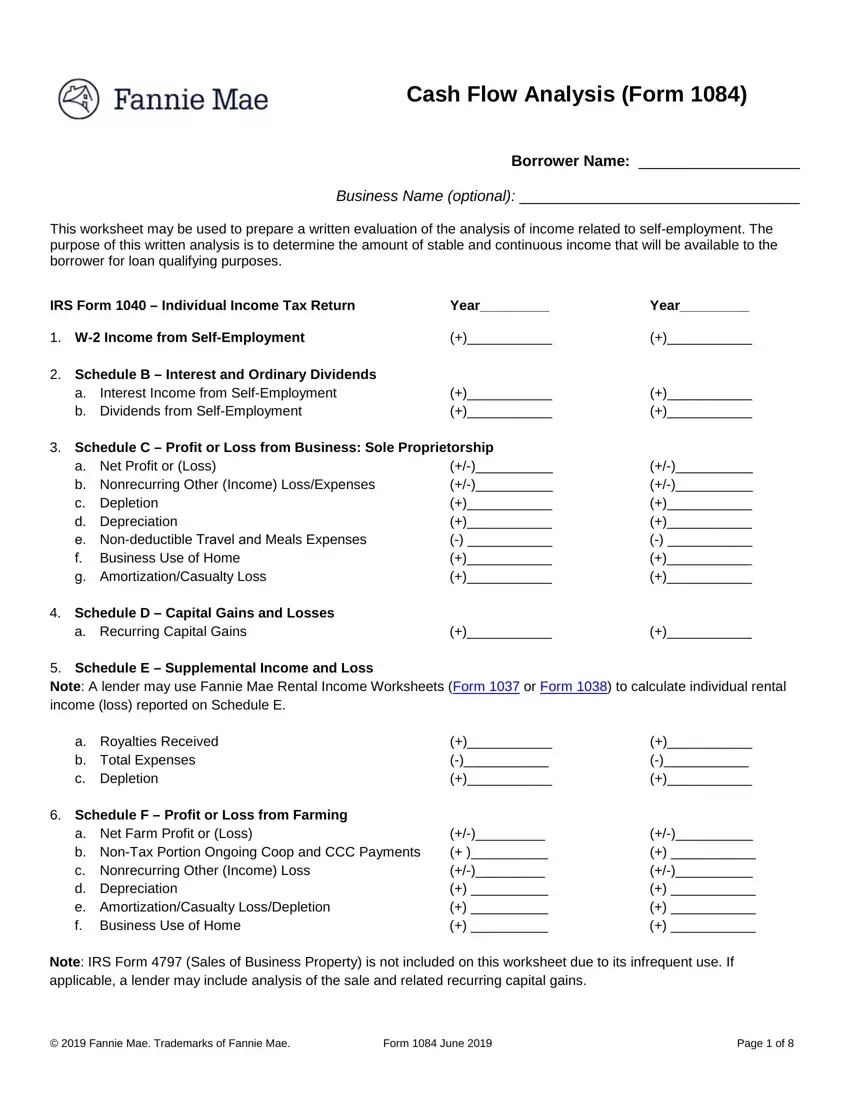

Fannie Mae Income Worksheet - Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and. Lease agreement or fannie mae form 1007 or form. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. Fannie mae publishes four worksheets that lenders may use to calculate rental income. 10k+ visitors in the past month Use of these worksheets is optional. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Schedule e or step 2b: 10k+ visitors in the past month Calculate monthly qualifying rental income (loss) using step 2a:

Fannie mae offers use of the income calculator as an optional tool to assist lenders in calculating qualifying income that is documented. Lease agreement or fannie mae form 1007 or form. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Use of these worksheets is optional. Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and. The purpose of this written analysis. 10k+ visitors in the past month Calculate monthly qualifying rental income (loss) using step 2a: 10k+ visitors in the past month Fannie mae publishes four worksheets that lenders may use to calculate rental income.

The purpose of this written analysis. Lease agreement or fannie mae form 1007 or form. 10k+ visitors in the past month Fannie mae offers use of the income calculator as an optional tool to assist lenders in calculating qualifying income that is documented. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. Fannie mae publishes four worksheets that lenders may use to calculate rental income. Calculate monthly qualifying rental income (loss) using step 2a: A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Schedule e or step 2b: Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and.

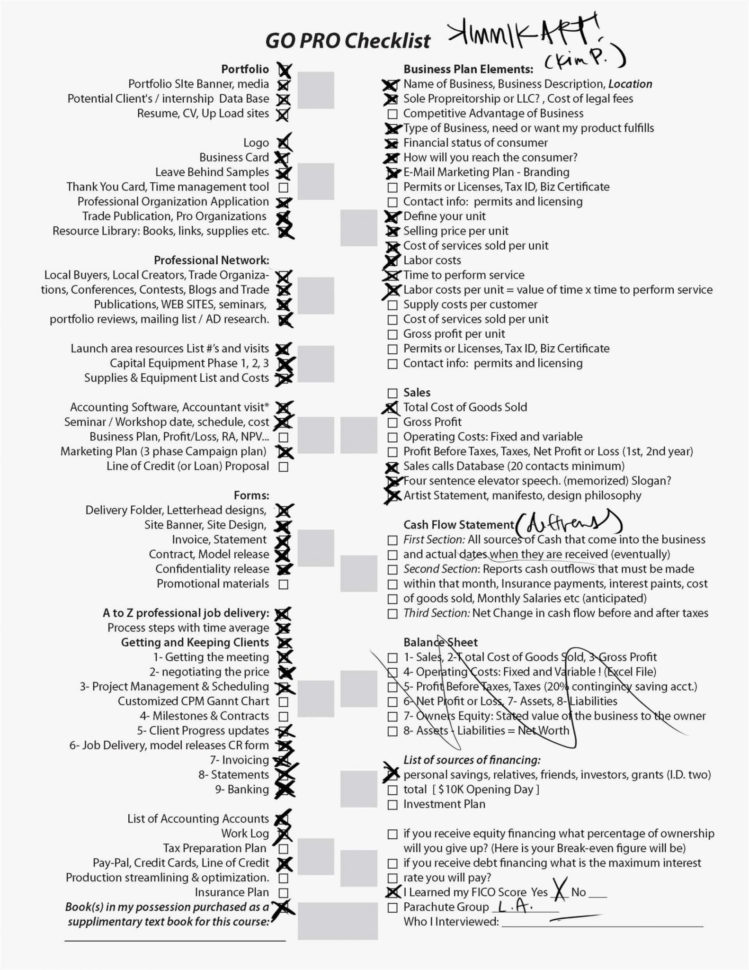

Fannie Mae Self Employed Worksheet Fill and Sign

Schedule e or step 2b: Use of these worksheets is optional. The purpose of this written analysis. Fannie mae offers use of the income calculator as an optional tool to assist lenders in calculating qualifying income that is documented. Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and.

Fannie Mae Rental Calc Worksheet

10k+ visitors in the past month Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. 10k+ visitors in the past month The purpose of this written analysis. Lease agreement or fannie mae form 1007 or form.

Fannie Mae Self Employed Worksheet

Schedule e or step 2b: 10k+ visitors in the past month Calculate monthly qualifying rental income (loss) using step 2a: Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. Fannie mae’s income calculator web interface is free to use and generates an immediate response including a.

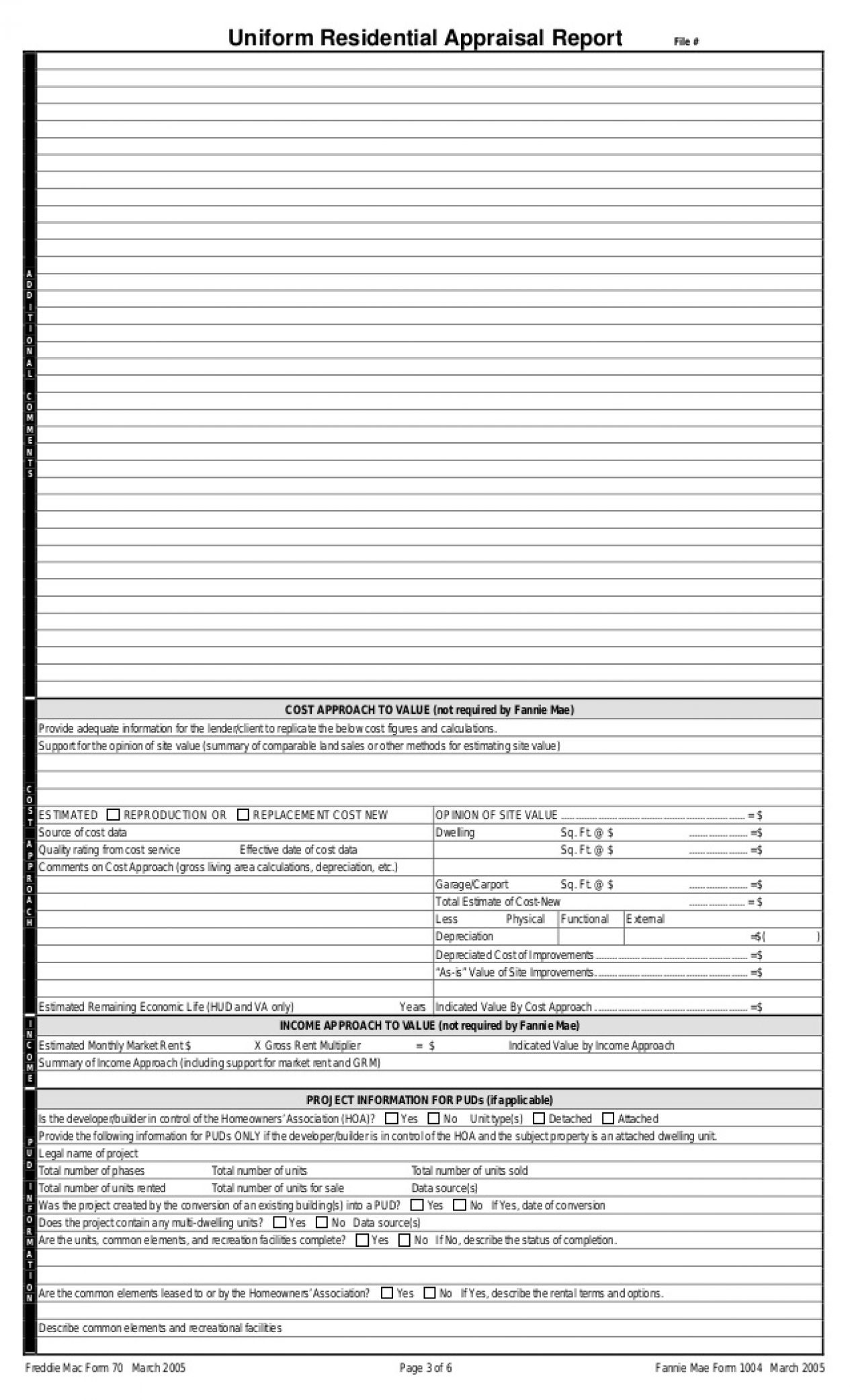

Fannie Mae Rental Worksheet Excel

Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. Schedule e or step 2b: Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and. 10k+ visitors in the past month A lender may use fannie.

Fannie Mae Self Employed Worksheet

10k+ visitors in the past month Lease agreement or fannie mae form 1007 or form. The purpose of this written analysis. Calculate monthly qualifying rental income (loss) using step 2a: Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and.

Fannie Mae Calculation Worksheet

Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and. Lease agreement or fannie mae form 1007 or form. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. Schedule e or step 2b: 10k+ visitors.

Fannie Mae W2 Calculation Worksheet

A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Schedule e or step 2b: 10k+ visitors in the past month Fannie mae offers use of the income calculator as an optional tool to assist lenders in calculating qualifying income that is documented. Use this worksheet to calculate.

Fannie Mae Rental Worksheet 2022

A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Schedule e or step 2b: 10k+ visitors in the past month Fannie mae publishes four worksheets that lenders may use to calculate rental income. 10k+ visitors in the past month

Fannie Mae Calculation Worksheets

Calculate monthly qualifying rental income (loss) using step 2a: Fannie mae offers use of the income calculator as an optional tool to assist lenders in calculating qualifying income that is documented. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. Fannie mae’s income calculator web interface.

Worksheet Fannie Mae

Fannie mae offers use of the income calculator as an optional tool to assist lenders in calculating qualifying income that is documented. Schedule e or step 2b: Calculate monthly qualifying rental income (loss) using step 2a: Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4. Lease.

Schedule E Or Step 2B:

Fannie mae’s income calculator web interface is free to use and generates an immediate response including a qualifying income amount and. 10k+ visitors in the past month 10k+ visitors in the past month The purpose of this written analysis.

A Lender May Use Fannie Mae Rental Income Worksheets (Form 1037 Or Form 1038) Or A Comparable Form To Calculate Individual Rental.

Fannie mae offers use of the income calculator as an optional tool to assist lenders in calculating qualifying income that is documented. Use of these worksheets is optional. Lease agreement or fannie mae form 1007 or form. Fannie mae publishes four worksheets that lenders may use to calculate rental income.

Use This Worksheet To Calculate Qualifying Rental Income For Fannie Mae Form 1038 (Individual Rental Income From Investment Property (S) (Up To 4.

Calculate monthly qualifying rental income (loss) using step 2a: