Dscr Excel Template - The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Here we will learn how to calculate dscr with examples and downloadable excel. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. Guide to debt service coverage ratio formula. Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial.

Guide to debt service coverage ratio formula. Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Here we will learn how to calculate dscr with examples and downloadable excel. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including.

Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Guide to debt service coverage ratio formula. Here we will learn how to calculate dscr with examples and downloadable excel.

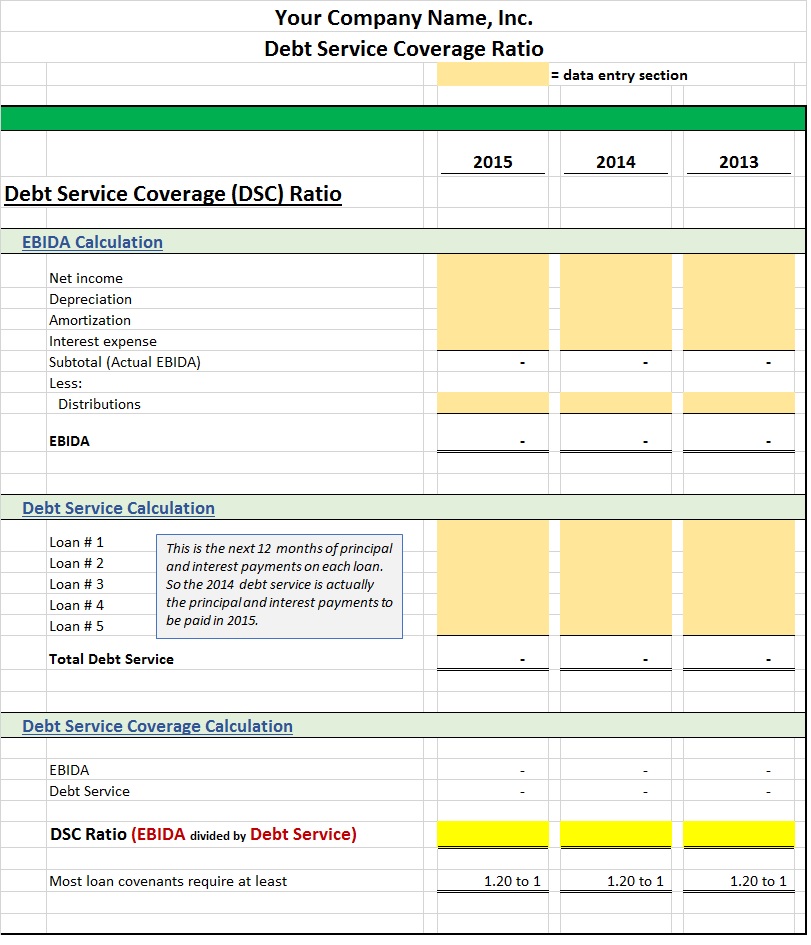

Debt Service Coverage Ratio Calculator Excel Template Free Download

Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. Guide to debt service coverage ratio formula. Here we will learn how to calculate dscr with examples and downloadable excel. Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr).

Dscr Excel Template

Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. Guide to debt service coverage ratio formula. Here we will learn how to calculate dscr with examples and downloadable excel. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Debt service.

Dscr Excel Template

The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Guide to debt service coverage ratio formula. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. Here we will learn how to calculate dscr with examples and.

Debt Service Coverage Ratio Formula in Excel ExcelDemy

Here we will learn how to calculate dscr with examples and downloadable excel. Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Debt service coverage ratio (dscr) measures the ability of.

Debt Service Coverage Ratio Formula in Excel ExcelDemy

The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. Guide to debt service coverage ratio formula. Debt service coverage ratio (dscr) measures the ability of a company to use its operating.

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel

Here we will learn how to calculate dscr with examples and downloadable excel. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Guide to debt service coverage.

Dscr Excel Template Printable Word Searches

Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. Guide to debt service coverage ratio formula. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. The debt service coverage ratio (dscr) is used to measure a.

How to Calculate Debt Service Coverage Ratio (DSCR) in Excel Sheetaki

Guide to debt service coverage ratio formula. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Here we will learn how to calculate dscr with examples and downloadable excel. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt.

Dscr Excel Template

Here we will learn how to calculate dscr with examples and downloadable excel. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt. Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. Debt service coverage ratio (dscr) measures the ability of.

Dscr Excel Template Printable Word Searches

Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. Here we will learn how to calculate dscr with examples and downloadable excel. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. The debt service coverage ratio.

Here We Will Learn How To Calculate Dscr With Examples And Downloadable Excel.

Learn how to build an excel template to efficiently calculate and interpret debt service coverage ratio (dscr) for financial. Guide to debt service coverage ratio formula. Debt service coverage ratio (dscr) measures the ability of a company to use its operating income to repay all its debt obligations, including. The debt service coverage ratio (dscr) is used to measure a company’s cash flow available to pay current debt.

:max_bytes(150000):strip_icc()/DSCR1-218052e5bc4240449f1479019381b358.jpg)